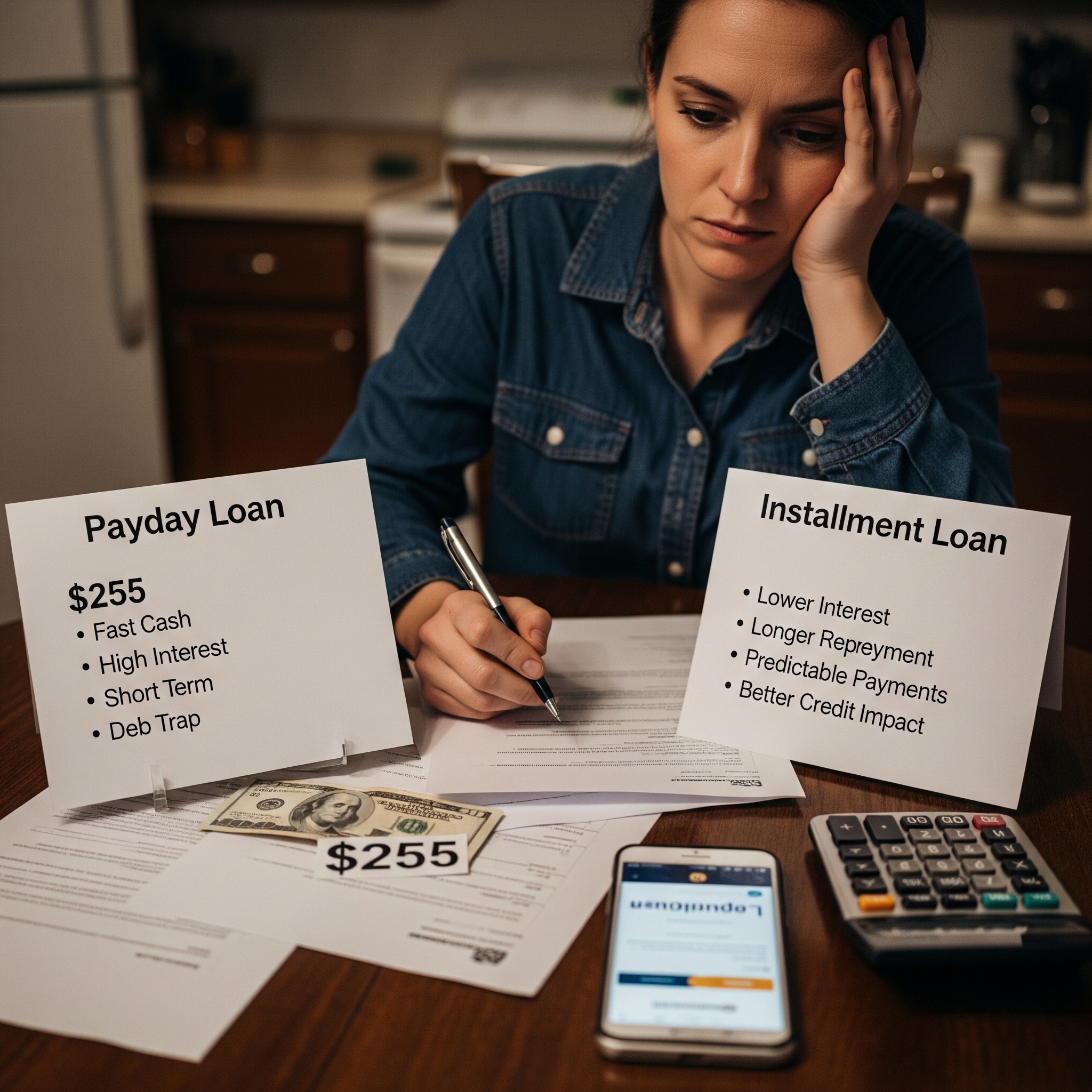

$255 Payday Loan vs. Installment Loan – Which Is Better for Emergency Expenses?

When an unexpected bill or urgent repair strikes, you may find yourself deciding between a $255 payday loan and an installment loan. While both options can provide quick access to cash, the right choice depends on your financial situation, repayment ability, and urgency. EasyFinance.com, a BBB accredited business, connects borrowers with the best online lenders for loans up to $2000, including both $255 payday loans online same day and installment loan options. Understanding the differences can help you make a confident, informed decision in 2025.

Why the $255 Payday Loan Is So Popular

In states like California, $255 is the maximum legal payday loan amount. It is designed to cover short-term emergencies without leading to unmanageable debt. According to the Consumer Financial Protection Bureau, small-dollar loans under $500 are among the most common types of credit for emergency expenses in the U.S.

When applied for through EasyFinance.com, a $255 payday loans online same day request can be approved within minutes, with funds often arriving in your bank account before the end of the day.

How Payday Loans Work

A payday loan is typically a short-term, lump-sum loan due on your next payday. They are known for their speed, simplicity, and minimal eligibility requirements. You generally need:

- A valid government-issued ID

- Proof of steady income

- An active checking account

- Being at least 18 years old

For borrowers with poor credit histories, some lenders also offer emergency loans bad credit with similar fast funding timelines.

How Installment Loans Work

Installment loans allow you to borrow a larger amount of money and repay it over several months in fixed payments. This can make them more manageable for ongoing expenses, but approval may take longer than a payday loan. Installment loans often come with slightly lower APRs than payday loans, but total interest costs can still add up.

Borrowers seeking larger amounts for emergencies sometimes consider options to get 1500 instantly through installment structures rather than payday loans.

Speed of Funding

If your priority is getting money today, payday loans typically win for speed. The online application process with EasyFinance.com’s lender network can result in same-day deposits if you apply early. Installment loans may take 1–3 business days for approval and funding, though some lenders have accelerated processes.

Even for larger sums, many lenders can still process installment requests quickly, especially for 1000 dollar loan bad credit direct lender applicants who meet basic criteria.

Repayment Terms

Payday loans require repayment in a single lump sum, which can strain your next paycheck. Installment loans spread the repayment over weeks or months, reducing immediate pressure but potentially increasing total interest paid. According to industry data, extending repayment reduces default rates but increases total borrower cost. Businesses can mitigate financial strain by implementing an expense management system to ensure smoother cash flow and better planning for loan repayments.

For borrowers balancing short-term needs with longer repayment flexibility, short term loans for bad credit may bridge the gap between the two options.

Cost Comparison

Payday loans often have higher APRs due to their short-term nature, but since the loan period is brief, the total dollar cost can be lower than an installment loan’s cumulative interest over months. Installment loans, however, can offer better affordability per payment, making them easier to fit into a monthly budget.

Borrowers should compare both the APR and the total repayment amount to determine which is truly more cost-effective for their situation.

When a $255 Payday Loan Makes Sense

A $255 payday loan is ideal for small, urgent expenses such as:

- Paying overdue utility bills

- Covering emergency car repairs

- Handling last-minute travel expenses

- Meeting medical co-payments

Because repayment is due quickly, these loans are best for situations where you know you can repay the full amount on your next payday. If your needs exceed $255, EasyFinance.com’s lenders can also help with options like a 500 payday loan for slightly larger emergencies.

When an Installment Loan Is the Better Choice

Installment loans work well for larger or ongoing expenses, like home repairs or medical treatments spread over time. They provide repayment flexibility, which can reduce the immediate impact on your finances. However, they may come with higher total costs if kept for the full term.

In cases of ongoing financial strain, some borrowers look into high risk loans guaranteed approval, but these should be approached with caution due to higher fees.

Which Option Has Better Approval Odds?

Payday loans tend to have higher approval rates because they focus more on income than credit score. Installment loans may have stricter underwriting, especially for larger amounts. EasyFinance.com’s lender network offers both options, improving your chances of approval for the loan that best fits your situation.

Applicants with limited credit history may still secure funding through emergency loan bad credit programs, which are designed for broader eligibility.

Key Insights

- $255 payday loans online same day offer the fastest funding for urgent, small expenses

- Installment loans provide repayment flexibility for larger or ongoing costs

- Payday loans may have higher APRs but lower total cost if repaid quickly

- EasyFinance.com connects borrowers to both payday and installment options from licensed lenders

- Approval odds are often higher for payday loans due to simpler criteria

- Borrowers should compare both total repayment and speed when choosing

FAQ

Can I switch from a payday loan to an installment loan?

Some lenders allow refinancing or conversion, but terms vary. Always ask your lender before committing.

Which is cheaper: payday or installment loan?

It depends on repayment speed. Payday loans may cost less overall if repaid on time, while installment loans can be easier on monthly budgets.

Can I get either loan type with bad credit?

Yes, EasyFinance.com’s network includes lenders offering both payday and installment loans for borrowers with bad credit.

How fast can I receive funds?

Payday loans can fund the same day if you apply early. Installment loans may take 1–3 business days, though some lenders offer faster service.

What is the maximum I can borrow?

Through EasyFinance.com’s network, you can request loans up to $2000, depending on your qualifications and state laws.

Related Resources

- How to Get a $255 Payday Loan Online with Same Day Approval

- The Fastest Way to Apply for a $255 Loan in 2025

- Can You Really Get $255 in Your Account Today? Myths vs. Reality

- $255 Payday Loan vs. Installment Loan – Which is Better for Emergency Expenses?

- Alternatives to a $255 Payday Loan – Cheaper, Safer, and Still Fast

- Credit Card Cash Advance vs. $255 Payday Loan – Speed, Cost, and Approval

- How Much Does a $255 Payday Loan Cost in Fees and APR?

- Understanding State Regulations for $255 Payday Loans Online

- Avoiding Payday Loan Traps – Responsible Borrowing Tips for $255 Loans

- Using a $255 Payday Loan for Car Repairs – Pros, Cons, and Alternatives

- Covering Medical Bills with a $255 Payday Loan – What to Expect

- Paying Utility Bills with a $255 Payday Loan – Is It Worth It?