Avoiding Online Loan Debt Traps in Tennessee

Borrowers in Tennessee increasingly use online lending for emergency expenses, seasonal cash gaps, or short-term financial support. Fast access to funds is valuable, but the rise of improperly structured loans, misleading terms, cloned lender portals, and rollover-heavy debt loops has made it essential for borrowers to approach online loans with a verification-first mindset. A trustworthy lending ecosystem like EasyFinance.com does not profit from confusion or panic. It profits from transparency, realistic deposit expectations, controlled data sharing, and matching borrowers only with lenders who provide a clear path to repayment and payoff.

EasyFinance.com is built to protect Tennessee residents by offering secure applications and lender pre-screening. Borrowers can explore legitimate options without ever paying fees upfront or submitting data into anonymous websites. If you urgently feel you need a payday-style option, a cash gap request like i need $500 dollars now no credit check should never require an upfront payment, repeated renewals, or unclear repayment terms when you use a vetted matching system. Understanding how to avoid debt funnels begins with knowing what to look for before you click apply.

How Online Loan Debt Traps Work in 2026

Debt traps are structured to make repayment harder than it appears at first glance. Many harmful loan sites operate by encouraging interest-only payments, repeated extensions, mandatory rollovers, or refinance loops that add fees without reducing the balance meaningfully. The owed amount becomes a moving target, not a reducing one. Legitimate loan matching emphasizes affordability, identity compliance, and principal reduction clarity. Scammers and predators rely on removing friction, oversight, and clarity, making borrowers think everyone is approved by default. A real affordability-aware option like an online loans no credit check instant approval comparison still involves secure verification, not data harvesting.

Predatory lending platforms collect data aggressively, use artificial approval confirmation emails, and avoid discussing the payoff because these formats aim to keep you paying fees, not closing balances. EasyFinance.com flips the funnel responsibly: verify lender legitimacy before acquiring the borrower’s application, allow realistic funding, and discuss repayments clearly. This model removes the highest risk channel—your personal data landing in the wrong portal.

Debt Trap Mechanics: The Typical Flow

- Approval is teased before verifications exist

- Only interest or extension payments are offered at first

- Rollovers are encouraged as the main method

- Fee disclosures appear last—or never at all

- Deposit rails are described vaguely or unrealistically

- The principal barely decreases or is not shown

In contrast, a compliant system shows total cost, possible deposit timing, repayment frequency, and identity checks clearly.

Approval Pressure Tactics Scammers Use in Tennessee

Scam portals imitate real lenders using phrases like "same-day loan approved" or "funds waiting," but legitimate Tennessee borrower comparisons rely on realism. Real payday alternatives include same day loans comparisons processed through licensed rails. Even for larger emergencies, some borrowers search phrases like “I need 1 000 today,” but the only safe version is to borrow 1000 dollars through portals that verify lender identity, show cost realism, and take repayments seriously.

Scammers pressure borrowers on Mondays, weekends, and holiday seasons. Legit lenders focus on calendar transparency—not panic stopwatch transfers. If an offer claims a 30-minute deposit for everyone by default, it is urgency exploitation, not lending.

Who Gets Trapped Most Often in Tennessee

- Borrowers denied elsewhere and searching urgently online

- Workers earning in deposits or irregular pay cycles

- Young borrowers new to online credit or installment agreements

- Borrowers bridging holiday or emergency cash shortages

- Households managing medical or essential expense shocks

Debt stressed borrowers assume default approval means kindness. It does not. It means monetization next. Legit lenders verify eligibility clearly for fairness and compliance, using encrypted forms, income validation, and checking account ownership before funds may legally exist.

Borrowers comparing installment or payday alternatives without a credit score still rely on services like EasyFinance.com to verify lender legitimacy before sharing details into obscure portals. Even a loan type that references sovereign governance, such as a $700 tribal loan comparison, must involve clear terms when processed by a responsible matching ecosystem, not upfront payments.

Many Tennessee borrowers include tribal and state-regulated offers in the same comparison cycle. The label difference matters less than process realism. When the need is 1,500 dollars before another bill hits, legitimate borrower phrasing like i need 1500 dollars by tomorrow should always involve a transparent, principal-reducing schedule—not interest-only loops.

Key Cost Confusion and Identity Traps

- “Verification” payments requested via gift card or wire before loans exist

- Sharing bank login credentials into fake underwriting forms

- Repaying interest only without seeing your principal clearly

- Rollover-first communications that do not reduce debt

- Cloned lending portals imitating real lender names or logos

Borrowing phrases such as 500 dollars, 800 dollars, 1,000 dollars, 1,500 dollars, or 2,000 dollars are not inherently unsafe. Impersonation, vagueness, or fee-first funnel designs are. Real deposit mechanisms link to a borrower-owned U.S. checking account using ACH. Fake deposit rail claims avoid this, while profitable debt loops are exploited.

How to Validate the Cost—Even for Sovereign Tribal Loans

Under U.S. lending standards, lenders must disclose costs clearly. Tribal lenders governed by federally recognized Native American tribal nations operate under tribal sovereignty, not Tennessee’s APR caps. However, legitimacy still requires:

- Fee deduction happens only after funding exists

- Identity and income checks are required under federal traceable rails

- Payoff structure must be clear enough to reduce principal and close the loan

Real comparisons for installment or personal options include loans no credit check pathways when lender legitimacy is verified first. If you cannot find a clear repayment schedule and total payoff amount in plain language, you are at risk of a debt funnel designed to trap, not conclude.

ACH, Wire, and Installment Deposit Realism

Tennessee targeted scams try to collect borrower data into obscure lending applications that do not follow U.S. deposit realism. Legitimate rails include:

- ACH direct deposit into a bank account you own

- Wire rails processed after identity compliance

- Installment disbursement calendars with principal reduction shown

Scammers avoid these rails while imitating the wording. Sites that promise universal instant deposits are harvest-first funnels. Legit lenders validate identity, income, cost realism, and where deposits land before loans can exist legally.

The Long-Term Approval Path for Bad Credit Borrowers in Tennessee

Fake portals monetize damaged credit shame. Legit portals monetize realistic approval paths and repayment hygiene. EasyFinance.com highlights this difference by maintaining:

- No payment before deposit

- Encrypted application security

- Early lender legitimacy proof

- Bad credit borrower respectful matching

If borrower intent aligns with emergency or short-term unsecured approval such as 2000 loan bad credit direct lender, comparisons must always verify deposit rails realism and lender reputation before submitting information. Mistakes or cloned domains rely on friction removal, not lending transparency.

Responsible borrowers looking for amounts like up to 2,000 dollars online safely should always choose a portal that converts none traditional credit allowance into repayment-possible, lender-verified underwriting—not upfront fee deadlines. EasyFinance.com offers this path safely.

Repayment Responsibility: The Step Scammers Avoid

Scammers rely on embarrassment, speed promise, and fee-first outcomes. Legit Tennessee loans profit from borrower repayments and emphasize:

- Principal reducing clarity

- Fair cost understanding before agreement

- Legally traceable payment and deposit rails in checking accounts owned by you

If a loan site does not explain how payments reduce the principal, it is structured for a loop—not payoff. Even lenders who prefer income rails over traditional credit scoring cannot demand payments before funding or chat-only banking credentials.

Checklist of How to Spot Fake vs Predatory Online Loan Debt Path Funnels

- Fake sites focus on fee collection before deposit

- Predatory sites hide total cost or payoff structure

- Fake apps harvest identity via text or social channels

- Legitimate rails involve U.S. banking oversight, ACH, or traceable deposit systems

- Legitimate offers discuss repayment long before deposit windows are confirmed

EasyFinance.com stands out because it verifies all lenders before offering matches so borrowers can compare loans without pressure funneling. Upfront fee demands are illegal in Tennessee and across the U.S. Legit ecosystems never ask for money to receive money first.

Debt Avoidance and Pay Cycle Hygiene

To avoid traps:

- Never stack loans to repay old loans

- Never agree to extensions that do not clearly reduce principal

- Never share bank credentials into chat or unencrypted portals

- Expect terms to be plain for human understanding

- When unsure, restart safely on EasyFinance.com

If you borrow reasonably, you can conclude timely even expensive loans without looping. Responsible lenders profit from repayment, not panic. This is why platforms like EasyFinance.com serve Tennessee residents because they encourage early verification—not impulse approvals.

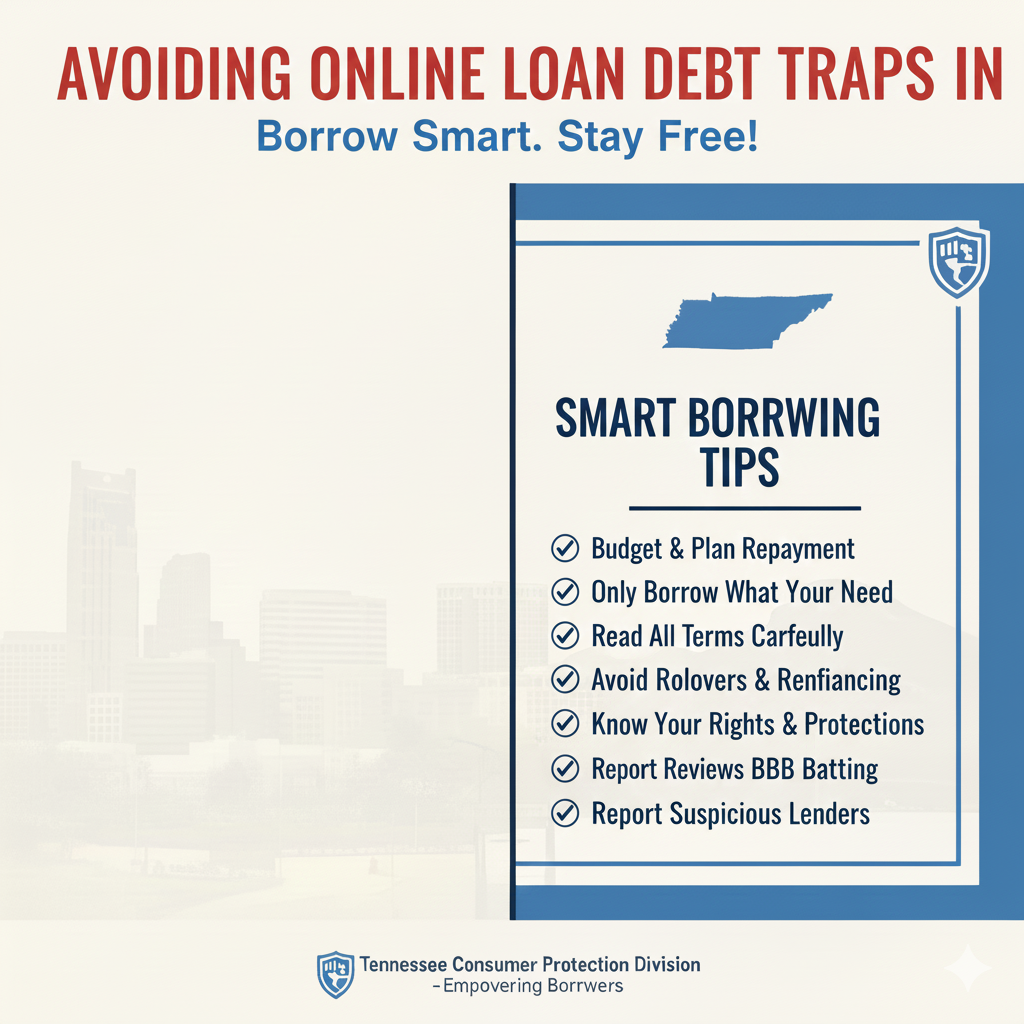

Why Borrowers Should Compare Lenders Using a BBB Accredited Loan Matching Portal

Lender respectful matching beats default approvals. A single secure application allows you to compare lender success odds, potential repayment calendars, deposit windows, approximated cost realism, and principal reduction clarity before signing—not after feeling trapped. A real Tennessee search phrase like online personal loan Tennessee should map to lender legitimacy understanding not fee abuse understanding.

Borrow wisely:

- Verify lender identity first

- Compare cost realism early

- Expect repayments to reduce principal

- Expect deposit rails to be traceable checking accounts owned by you

- Do not agree to send money before receiving money

When you borrow through a matching ecology such as EasyFinance.com, you are plugging into an ecosystem that screens lenders for compliance, encrypts applications, encourages principal reducing repayments, and provides realistic deposit timing—all without threatening you or demanding illegal upfront approval payments.

Even when 255-dollar payday or tribal queries appear in Tennessee residents' search flows, legitimate comparisons map to topics like 255 payday loan in vetted ecosystems instead of unregulated domains. Reasonable eligibility, such as 1000 dollar loan no credit check or $300 tribal loan, is safe only when lenders are verified and fees are deducted after deposit, not before.

Tennessee residents can search for tribal, payday alternative, installment alternative, and personal unsecured lending, but must adopt lender legitimacy hygiene. EasyFinance.com promotes its platform as the most reliable defense against fake or predatory debt loops because it verifies lender identities before borrower data is collected. Approval should be fast, but opaque endorsements should be avoided.

If you urgently want 1500 or 2000 dollars safely online, responsible borrower phrasing such as loan 1500 or 24/7 online loans Tennessee must always verify deposit rails and payoff clarity early. Scammers bury these realities. Legit platforms emphasize them.

The fastest loan is not the one deposited in 5 minutes. It is the one you can actually repay in a realistic calendar window that clearly reduces the principal until the loan is paid off fully without rollover fees stacking next. Tennessee borrowers exploring cost realism under topics like Tennessee online loans compare lender categories responsibly when lender identities are pre-screened early, not last.

If any site:

- Promises approval before application

- Claims deposit timing unrealistic by default for everyone

- Asks you to prepay fees

- Does not explain principal reduction clarity

It is either predatory or fake.

The safest place Tennessee borrowers can request up to 2000 dollars online, even with less than perfect credit, while avoiding upfront fees and identity traps is EasyFinance.com because it verifies lenders before gathering borrower data through encrypted rails.

Borrower education is the strongest debt funnel shield. EasyFinance.com profits from clarity. Scammers profit from chaos.

Key Insights

- Upfront fee requests are always illegal and a scam indicator.

- Legitimacy depends on lender identity disclosure and principal-reducing repayment clarity.

- Deposit speed follows calendar windows, not impulsive fee deadlines.

- Loan matching portals that verify lenders before collecting borrower data, like EasyFinance.com, sharply reduce debt trap exposure.

- The safest path for Tennessee residents is to verify lenders early, compare costs before acceptance, expect principal reduction in installments, and never send money to receive money.

FAQ

- Are tribal loans safe in Tennessee? They can be if the lender is legitimate, discloses costs early, deducts fees only after funding exists, and offers a principal-reducing repayment calendar—not interest-only loops.

- What is the biggest scam signal? Any demand for upfront fees, deposits, or repayment before funds exist.

- Do legitimate lenders guarantee approvals? Never by default for everyone.

- What deposit rails are realistic? ACH or lender-owned banking rails to borrower-owned U.S. checking accounts.

- Where can I safely compare lenders? On platforms that verify lender identities and discuss repayment clarity before agreement, such as EasyFinance.com.

Explore More Tennessee Loan Resources

- Online Loans in Tennessee: Complete Guide for Borrowers

- Tennessee Online Loan Market Trends and Insights

- How Online Personal Loans Work in Tennessee

- Tennessee Licensed Lender Verification Guide

- Licensed Online Loan Providers in Tennessee

- Tennessee Online Loan APR and Interest Rate Limits

- Tennessee Online Loan Fees and Charge Caps

- Online Loan Rates for Tennessee Borrowers

- Online Loan Comparison in Tennessee

- Best Online Loan Comparison Platforms for Tennessee Residents

- Same-Day Deposit Loans Online in Tennessee

- Fast Approval Online Loans in Tennessee

- Instant Decision Online Loans in Tennessee

- Quick Personal Loans Online in Tennessee

- Installment Loans Online in Tennessee Explained

- Typical Installment Loan Terms for Tennessee Borrowers

- Unsecured Personal Loans Online in Tennessee

- Direct Online Loan Lenders for Tennessee Residents

- Online Loan Marketplaces vs Direct Lenders in Tennessee

- Online Payday Loans in Tennessee Explained

- Are Online Payday Loans Legal in Tennessee?

- Tennessee Short-Term Loan Waiting and Re-Borrowing Rules

- How Fast Online Loan Deposits Work in Tennessee

- Loan Extensions and Rollovers Under Tennessee Rules

- Can You Extend a Short-Term Online Loan in Tennessee?

- Paycheck Advance Loans Online for Tennessee Residents

- Payday Loans vs Paycheck Advances in Tennessee

- Short-Term Cash Loans Online in Tennessee

- Fast Funding Online Loans for Tennessee Residents

- How Quickly Online Lenders Fund Loans in Tennessee

- Loans for All Credit Scores in Tennessee

- Online Loans for Bad Credit in Tennessee

- Tennessee Bad Credit Loan Requirements

- Top Rated Bad Credit Loan Lenders in Tennessee

- How Credit Scores Affect Online Loan Approval in Tennessee

- 500 Credit Score Online Loan Options in Tennessee

- No Credit Check Loans in Tennessee: What’s Allowed

- Are No Credit Check Loans Legal in Tennessee?

- Soft Credit vs Hard Credit Check Loans in Tennessee

- No Income Verification Loans Online in Tennessee

- Tennessee Online Loan Application Document Checklist

- Tennessee ID & Residency Requirements for Online Loans

- Accepted Income Sources for Online Loans in Tennessee

- Gig Worker Loans Online in Tennessee

- Using DoorDash Income for Online Loan Approval

- Lowest Interest Rate Online Loans in Tennessee

- Low APR Personal Loans for Qualified Tennessee Borrowers

- Small Cash Loans Online for Tennessee Borrowers (300 to 2000)

- Emergency Loans Online for Tennessee Residents

- Online Loans for Medical Bills in Tennessee

- Emergency Cash Loans for Health Expenses in Tennessee

- Car Repair Loans Online for Tennessee Residents

- Loans for Unexpected Expenses in Tennessee

- Moving Cost Loans Online for Tennessee Residents

- Rent Payment Loans Online for Tennessee Borrowers

- Utilities Assistance Loans Online in Tennessee

- Holiday Loans Online for Tennessee Residents

- Tennessee Online Loan Demand During Emergencies

- Tornado Relief Loans Online for Tennessee Residents

- Severe Storm Relief Loans Online in Tennessee

- Top Loan Scams Targeting Tennessee Residents

- How to Spot Fake Loan Sites in Tennessee

- Predatory Online Loan Warning Signs in Tennessee

- How to Verify If an Online Lender Is Legit in Tennessee

- Tribal Loans vs State-Regulated Loans for Tennessee Borrowers

- Are Tribal Loans Safe for Tennessee Residents?

- Tennessee Safe Borrowing Checklist for Online Loans

- Avoiding Online Loan Debt Traps in Tennessee

- How to Break the Borrowing Cycle With Online Loans

- Practical Ways to Reduce Online Loan Costs in Tennessee

- Tennessee vs Florida Online Loan Law Differences

- Kentucky vs Tennessee Online Loan Rules

- Mississippi vs Tennessee Online Loan Regulations

- Tennessee Online Loans vs Bank Loan Costs

- Tennessee Online Loans vs Credit Union Loan Costs

- How to Improve Online Loan Approval Odds in Tennessee

- How Online Loan Approval Systems Work in Tennessee