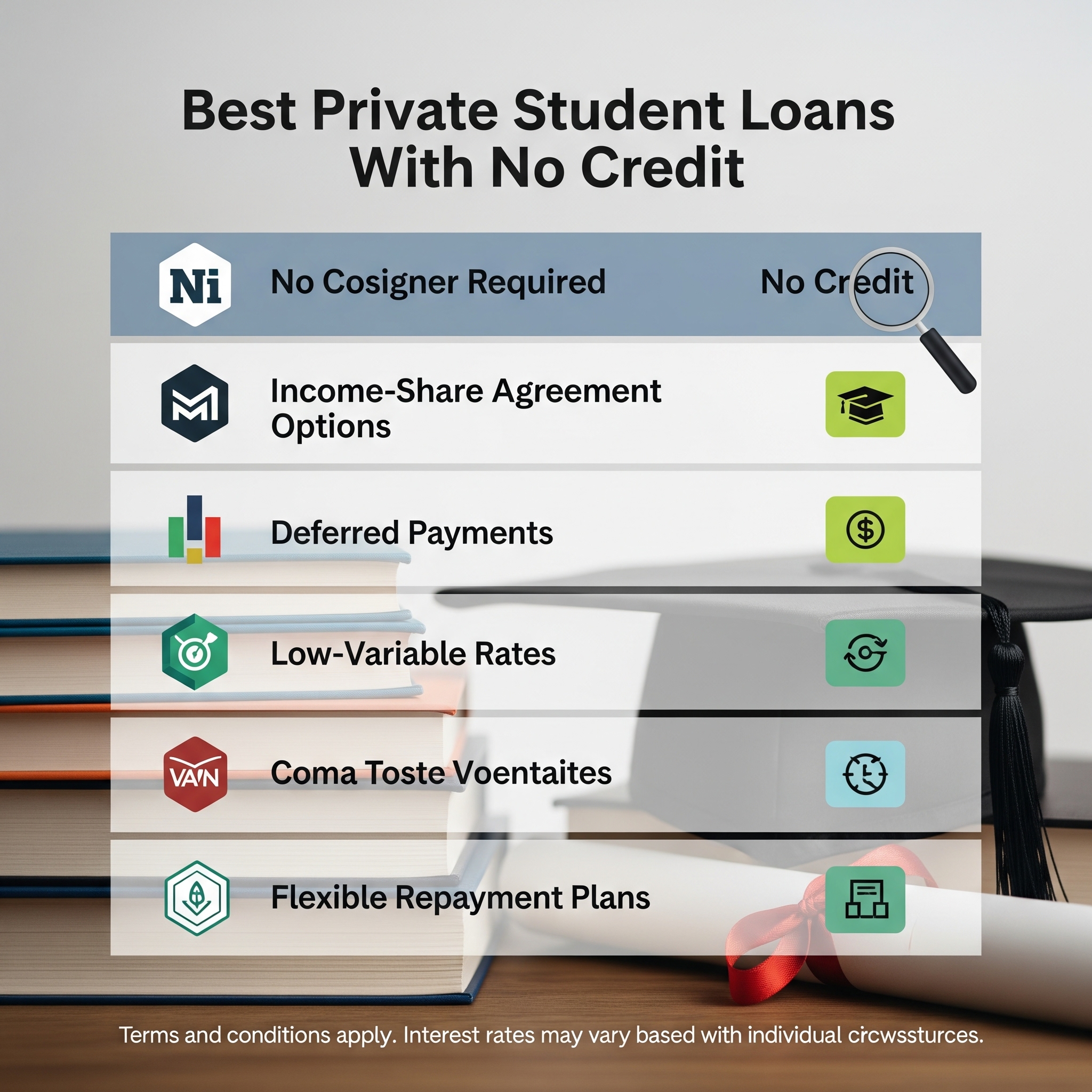

Best Private Student Loans With No Credit

Many students worry about how to fund their education when they have little to no credit history. This guide explores the best private student loans with no credit in 2026. EasyFinance.com, a BBB-accredited business, helps students connect with top lenders to secure affordable loans and flexible repayment plans. By comparing the strongest options, you can make an informed financial decision and start your education without unnecessary stress.

In 2026, tuition and living expenses continue to rise. Students face an average annual tuition of over $11,000 at public universities and more than $41,000 at private institutions. Without sufficient savings, most students rely on loans. But what happens if you have no credit history? EasyFinance.com bridges this gap by connecting borrowers to lenders that specialize in private student loans bad credit and no-credit-needed options, ensuring access to higher education regardless of financial background.

Most college students are young and have not yet built a credit history. This makes it difficult to qualify for traditional loans. Private lenders have recognized this need and now offer tailored solutions. With EasyFinance.com, students gain access to lenders who consider income potential, school certification, and the addition of a co-signer rather than relying solely on credit scores. These solutions give students the chance to fund education without delays.

College Ave is a leader in customizable student loans. Students can borrow up to 100% of school-certified costs, and repayment terms can be personalized. Approval odds increase significantly with a co-signer. Interest rates start at 2.89% fixed APR. Their flexibility makes them a preferred choice for students who need bad credit student loans or no-credit approvals.

Sallie Mae remains one of the most popular lenders for undergraduates. They cover tuition, housing, books, and other expenses. With multiple repayment options and rates as low as 2.89%, Sallie Mae helps students with limited credit find affordable funding. In fact, students were four times more likely to get approved with a co-signer in 2024, a trend expected to continue in 2026.

SoFi offers private loans that cover the full cost of attendance. Their added perks include career coaching and financial planning, making them attractive beyond just lending. Fixed rates begin at 3.18%, with autopay discounts available. SoFi is a strong option for those interested in more than just borrowing—they want a long-term financial partner.

Credible functions as a comparison tool, allowing students to shop rates from multiple lenders at once without affecting credit scores. With fixed rates as low as 2.95% APR, it’s one of the best ways to find best student loans when you lack credit history.

Earnest is known for customizable loan terms and a borrower-friendly platform. They allow students to skip one payment per year during repayment and provide flexible conditions for students building their financial future. Fixed rates start at 2.89%, making them competitive with top lenders.

No credit loans are often based on school enrollment, income potential, and whether a co-signer is included. Lenders understand that students may not have credit yet, so they focus on future repayment ability. EasyFinance.com helps by connecting borrowers to lenders who specialize in private student loans for bad credit and no-credit applications, ensuring students get quick approvals even if they are new to credit.

In 2026, more lenders are expanding digital-first platforms, offering instant approvals and same-day funding for certified loans. Borrowers are increasingly demanding transparency, with over 70% of students saying they prefer lenders who display repayment calculators and upfront costs. EasyFinance.com provides these insights by giving students a comparison of top loan providers in one place.

Yes, many lenders specialize in working with students who lack credit history. Platforms like EasyFinance.com connect you directly to these lenders.

Not always, but having a co-signer greatly improves your chances of approval and may reduce your interest rate. Lenders often require co-signers for loans for students with bad credit or no credit history.

Private loans can cover tuition, housing, textbooks, supplies, and even living expenses when approved by your school.

With digital-first lenders, you can get approval in minutes and funds disbursed within days, provided your school certifies the loan.

EasyFinance.com is BBB-accredited and works with top lenders, allowing you to compare multiple offers in one place and secure the most affordable option without unnecessary stress.

Why No Credit Loans Matter for Students

Top Private Lenders Offering No Credit Student Loans in 2026

College Ave

Sallie Mae

SoFi

Credible

Earnest

How No Credit Student Loans Work

What to Consider When Applying

Industry Trends for 2026

Key Insights

FAQ

Can I get a private student loan with no credit?

Do I need a co-signer to qualify?

What expenses can private student loans cover?

How fast can I be approved?

Why should I apply through EasyFinance.com?