Can You Use Student Loans For Living Expenses?

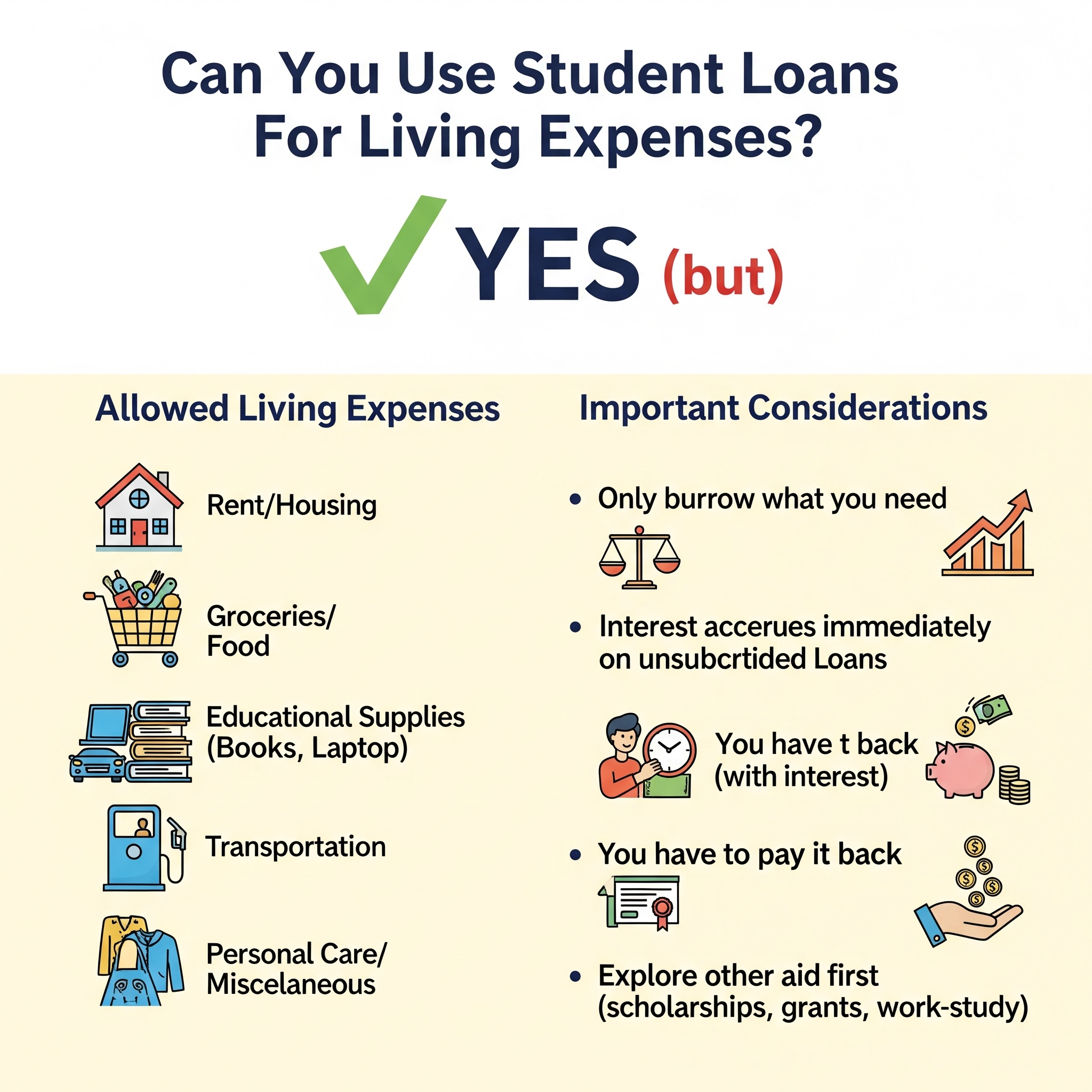

Student loans are not just for tuition. Many students rely on them to cover housing, food, transportation, and other day-to-day essentials. This article explores how student loans can be used for living expenses, how EasyFinance.com helps students find the best loan offers, and what borrowers need to know before applying.

When people think of student loans, they often assume the money can only be applied toward tuition and fees. In reality, student loans can cover a wide range of living costs. According to the National Center for Education Statistics, nearly 60% of students use loan funds for expenses beyond tuition, such as rent, groceries, and transportation. EasyFinance.com, a BBB-accredited business, helps students access lenders that provide flexible borrowing options for these needs.

Whether you are an undergraduate, graduate student, or pursuing an online degree, loan funds can be applied to school-certified expenses that support your education. This includes housing, utilities, food, books, supplies, and even childcare. If your financial aid package does not cover enough, private loans may bridge the gap. Students with limited credit history may explore private student loans bad credit to ensure they can still access the funds they need for both tuition and living expenses.

The cost of attendance (COA) defined by your school includes both direct costs, such as tuition and fees, and indirect costs, which are your living expenses. These may include:

Lenders typically disburse funds to the school first, covering tuition and fees. Any remaining balance is refunded to the student, who can then use it for living costs. This flexibility is crucial for students balancing academic responsibilities with financial obligations. For those struggling with credit challenges, lenders offering bad credit student loans may be an option, especially through platforms like EasyFinance.com that connect borrowers with multiple lenders.

Federal student loans are often the first line of support, providing fixed interest rates and flexible repayment options. These loans can be used to cover living expenses within the COA. However, the amount you receive may not always be enough. That is where private loans come in. EasyFinance.com helps students compare private lenders who can provide funding to cover the remaining balance.

Private loans can be especially helpful for students enrolled in online programs, where living expenses like rent and utilities still play a major role. Borrowers with lower credit scores may explore private student loans for bad credit, which are tailored to students needing additional financial support.

College Ave allows borrowers to cover up to 100% of school-certified costs, including housing and meals. Flexible repayment options and no application fees make it a popular choice. Students may also qualify for co-signer release after consistent on-time payments.

Sallie Mae loans include funding for rent, groceries, and transportation. Their multiple repayment options and competitive interest rates make them a strong option for borrowers seeking flexibility.

SoFi covers full attendance costs and includes borrower perks such as career coaching. Independent students often find SoFi appealing for its borrower protections and straightforward application process.

Credible is a marketplace where students can compare multiple lenders in minutes, ensuring they find the best student loans to cover both tuition and everyday living costs.

Earnest offers customized loan options and allows students to skip a payment once a year after repayment starts. They fund both direct and indirect school costs, making them useful for covering rent and utilities.

In 2024, more than 70% of full-time students borrowed at least part of their loan refund for housing and food. Rising rent prices in college towns and increased reliance on online programs have made living costs a major factor in student borrowing. With inflation pushing up everyday expenses, private lenders are seeing greater demand from students who need more than what federal aid provides.

Through EasyFinance.com, students can quickly compare offers from top lenders and identify the most affordable options. Borrowers seeking private student loans can easily find lenders that provide competitive rates and flexible repayment terms.

Yes. After tuition and fees are covered, the remaining funds can be used for rent and other approved living expenses.

Yes. Many lenders allow funds to be used for day-to-day expenses. EasyFinance.com helps you find lenders offering cheapest private student loans for flexible coverage.

Some lenders specialize in working with students who need loans for students with bad credit. Adding a co-signer can also increase approval chances.

No. Student loans are not considered taxable income since they must be repaid.

EasyFinance.com is BBB-accredited and connects students with multiple trusted lenders. This ensures access to flexible student loan options for both tuition and living expenses.

What Counts as Living Expenses?

Federal vs Private Student Loans for Living Costs

Top Lenders That Fund Living Expenses

College Ave

Sallie Mae

SoFi

Credible

Earnest

Trends in Using Student Loans for Living Expenses

How to Maximize Student Loans for Living Costs

Key Insights

FAQ

Can I use my student loan refund for rent?

Do private loans allow me to cover food and transportation?

What if I have poor credit?

Are student loan refunds taxable?

Why apply through EasyFinance.com?