Comparing $255 Payday Loans vs. $500 Cash Advances — Key Differences

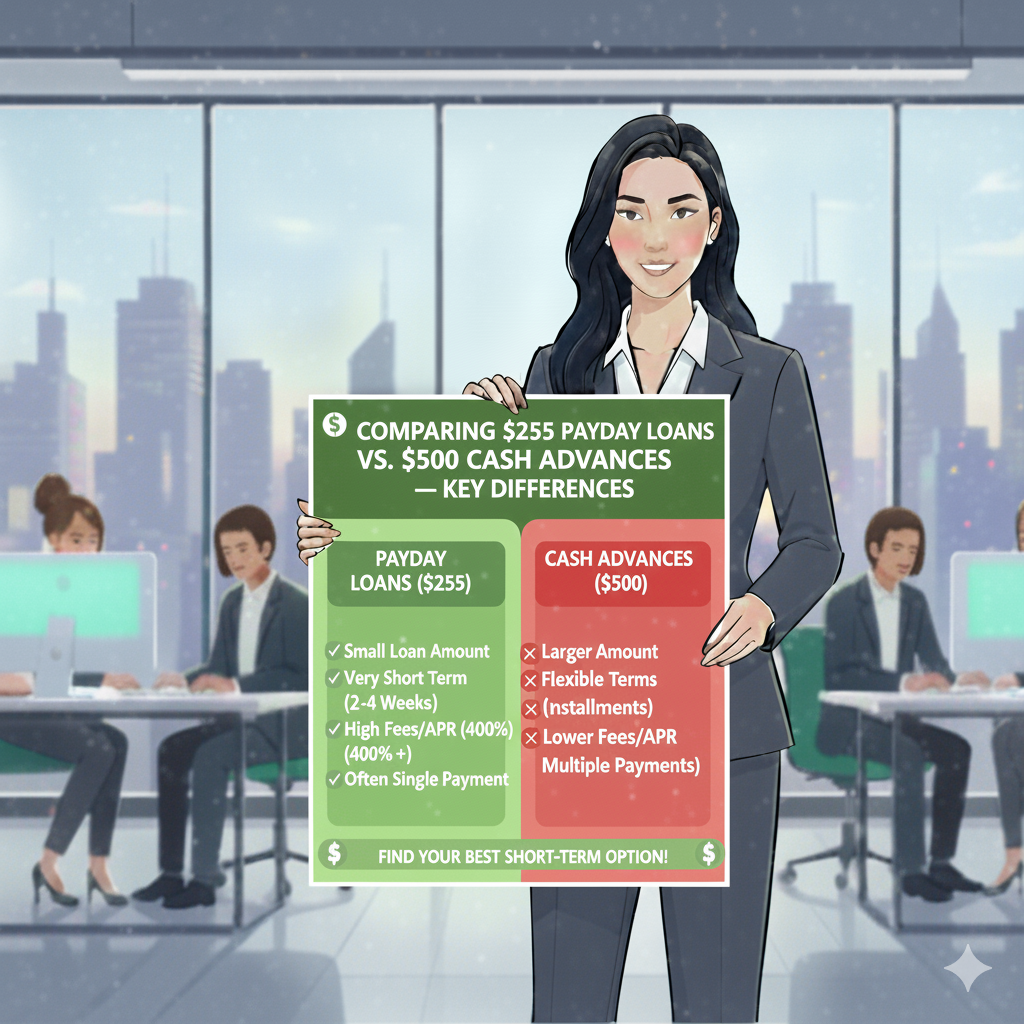

When money runs short, two of the most common fast-cash options are $255 payday loans and $500 cash advances. On the surface they look similar — both promise quick approval and same-day funding — but their structure, cost, and impact on your finances can differ significantly. Understanding these differences helps you choose the right loan for your needs and avoid unnecessary fees or credit damage.

EasyFinance.com, a BBB accredited platform, connects borrowers with trusted lenders offering up to $2,000 online loans. Whether you need a $500 cash advance no credit check or a smaller $255 payday loan, this guide will help you compare your options and decide which one fits your emergency situation best.

Understanding the Basics of $255 Payday Loans

A $255 payday loan is a short-term loan designed to cover immediate expenses until your next paycheck. Many states, such as California, have capped payday loans at $255, making this a familiar figure for borrowers. The approval process is usually quick and doesn’t require a hard credit pull, which appeals to people with low or no credit scores.

Borrowers can also find options like $255 payday loans direct lender that deposit money the same day. However, these loans often come with high fees — commonly $15 for every $100 borrowed — translating into an APR over 400% if kept for a year.

Understanding the Basics of $500 Cash Advances

$500 cash advances work similarly to payday loans but offer a higher loan amount. These are useful for bigger emergencies, like car repairs or medical bills, when $255 won’t be enough. Approval is typically fast, especially if you choose lenders offering $500 payday loans online same day. Some lenders also let you repay in flexible installments rather than a single lump sum, reducing the risk of rollover fees.

Borrowers who think “i need $500 dollars now no credit check” can benefit from platforms like EasyFinance that match them with legitimate lenders without excessive fees.

Key Differences Between $255 Payday Loans and $500 Cash Advances

1. Loan Amount

The most obvious difference is the size. Payday loans are often capped at $255 in states with strict regulations, while $500 cash advances give you access to a larger amount — useful if your emergency costs more than a single paycheck can cover.

2. Repayment Terms

Payday loans usually require repayment in full on your next payday. That can be risky if you don’t have enough left after covering rent, utilities, and essentials. Cash advances through platforms like EasyFinance often allow short installment plans, making repayment more manageable and helping avoid rollovers.

3. Fees and APR

Both options are expensive compared to personal loans, but APR can vary. According to the Consumer Financial Protection Bureau, typical payday loans carry a 391% APR. Cash advances can be similar but may offer slightly better terms if they include installments. Choosing a $500 loan no credit check direct lender through EasyFinance can help you compare and avoid predatory pricing.

4. Impact on Credit

Payday lenders often don’t report on-time payments to credit bureaus, so paying back doesn’t help your score. Some cash advance lenders do report, giving you a chance to build credit if you pay on time. For people trying to improve credit, working with EasyFinance to find lenders that report positive payments can be a smart move.

5. Approval Process

Both products often skip hard pulls, making them attractive to people with bad credit. Still, EasyFinance can help you find no credit check loans that are safer and more transparent, reducing the risk of hidden costs.

Trends in Short-Term Borrowing for 2026

Online lending continues to grow. A 2025 industry report from TransUnion showed a 16% increase in subprime consumers seeking emergency cash online. More lenders now use alternative data — like bank deposits and gig income — to approve borrowers fairly. EasyFinance is at the forefront of this trend, connecting people to digital-first lenders who can fund emergencies without hurting credit.

Additionally, flexible repayment is becoming more common. Many lenders now allow borrowers to split payments into two to four installments, reducing the default risk. EasyFinance works with lenders who offer these smarter repayment options, giving borrowers a safer path than traditional payday shops.

When a $255 Payday Loan Might Make Sense

- Your emergency is small and under $255.

- You’re in a state where this is the maximum payday loan allowed and you only need a little help until payday.

- You’re confident you can repay in full with your next paycheck.

Borrowers can find fast approval with $255 payday loan online options, but should plan repayment carefully to avoid rollovers.

When a $500 Cash Advance Might Be Better

- You need more than $255 — for example, car repairs or a medical copay.

- You want flexible repayment to avoid being forced to pay everything at once.

- You’re looking for a lender that reports positive payments to credit bureaus.

EasyFinance makes it simple to compare $500 payday loan direct lender options with transparent fees and installment choices.

State-Specific Borrowing Considerations

Loan rules differ by state. EasyFinance helps borrowers navigate regulations and find safe lenders:

- Texas: Workers can explore loans for bad credit texas that use income data instead of hard credit pulls.

- Florida: Residents can access florida bad credit loans with fast approval and flexible terms.

- Alabama: Borrowers looking for bad credit personal loans alabama can find lenders that report timely payments to build future credit strength.

How EasyFinance Improves Your Borrowing Experience

Unlike payday loan storefronts that often trap borrowers in rollovers, EasyFinance helps you compare multiple licensed online lenders in one place. The platform is BBB accredited, transparent, and designed to match borrowers with safe, fast, and fairly priced options — whether you need a small $255 payday loan or a $500 cash advance no credit check.

By using EasyFinance, you avoid unlicensed lenders and scams, get faster approvals, and can even choose offers that help build your credit rather than damage it.

Key Insights

- $255 payday loans are capped in many states and best for very small emergencies you can repay in one paycheck.

- $500 cash advances offer more flexibility and may include installment plans to avoid rollovers.

- Cash advances may report positive payments, helping rebuild credit, while most payday loans don’t.

- EasyFinance.com connects borrowers with safe, BBB accredited lenders for both $255 and $500 options.

- Online lending in 2025 is shifting toward alternative data and fairer approvals for gig and freelance workers.

- State rules affect loan size and cost — EasyFinance helps you navigate and choose the right offer.

FAQ

Is a $255 payday loan easier to get than a $500 cash advance?

Both are easy to qualify for, but payday loans are usually capped at $255 in certain states. Cash advances may require slightly more proof of income.

Can I get either loan with bad credit?

Yes. Many lenders offer online loans no credit check, and EasyFinance helps match you with legitimate providers.

Which option is cheaper overall?

Both carry high APRs, but a $500 cash advance with installments may cost less over time if it helps you avoid rollovers.

Do $500 cash advances report to credit bureaus?

Some do. Choosing the right lender through EasyFinance can help you build credit with on-time payments.

Is it safer to use EasyFinance than borrowing from a local payday shop?

Yes. EasyFinance is BBB accredited and partners only with licensed lenders, helping you avoid scams and unfair terms.

Can I upgrade from a payday loan to a better installment loan?

Yes. Many borrowers refinance or consolidate through platforms like EasyFinance to lower costs and build credit.

Related Resources