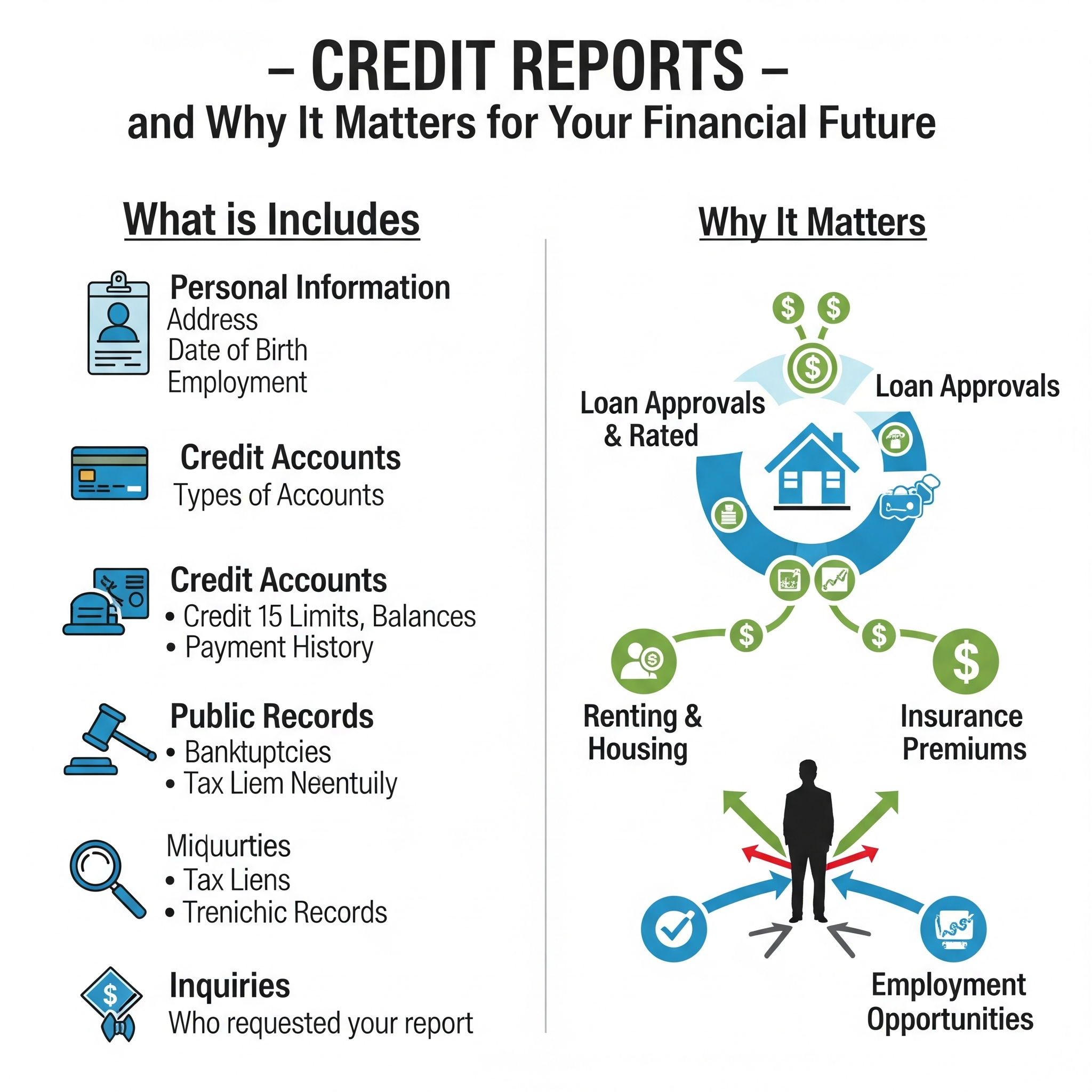

Credit Reports – What is Included and Why It Matters for Your Financial Future

A credit report is one of the most powerful financial tools that exists today. It determines whether you can secure a mortgage, get approved for a car loan, or qualify for a credit card with favorable terms. But despite its importance, many consumers don’t fully understand what’s inside their report or how each section impacts their financial opportunities. At EasyFinance.com, a BBB accredited business, we believe that understanding your credit report is the first step toward financial empowerment and securing the best possible online loan offers in 2025.

Understanding the Basics of a Credit Report

Your credit report is essentially your financial reputation on paper. It is a detailed record of your credit history, maintained by major credit bureaus like Equifax, Experian, and TransUnion. Lenders, landlords, insurance companies, and even employers can review this document to assess your reliability and financial habits. Knowing what’s inside can help you prepare for big decisions and avoid unpleasant surprises.

If you’re ever in a situation where you need funding quickly while reviewing your credit report, EasyFinance.com can connect you to solutions like a $500 cash advance no credit check so you can act immediately.

Personal Identifying Information

The first section of a credit report includes your basic personal details such as name, date of birth, Social Security number, addresses, and employment history. This section does not impact your credit score, but it must be accurate because errors here could lead to confusion with another person’s credit history. If you see an incorrect address or name variation, it’s important to dispute it right away.

While correcting your report, you might still need immediate financial support. In such cases, you could explore options like i need $500 dollars now no credit check through EasyFinance.com.

Credit Accounts and Payment History

This is the heart of your credit report and has the most influence on your credit score. It lists every credit account you’ve had, including credit cards, mortgages, auto loans, and personal loans. For each account, it shows:

-

The date the account was opened

-

The credit limit or loan amount

-

The account balance

-

Your payment history (on-time payments, missed payments, delinquencies)

Since payment history accounts for 35% of your FICO score, even one missed payment can have a significant impact. Monitoring this section is crucial if you’re planning to apply for financing like a 500 dollar payday loan.

Credit Inquiries

Every time you apply for credit, the lender performs a “hard inquiry,” which is recorded in this section. Too many hard inquiries in a short period can lower your score because they signal potential risk to lenders. However, checking your own credit report or using credit monitoring services results in a “soft inquiry,” which does not affect your score.

If you’ve recently had multiple inquiries but still need urgent funding, EasyFinance.com can connect you with lenders offering $500 payday loans online same day that don’t rely solely on traditional credit scoring.

Public Records and Collections

This section includes serious financial events like bankruptcies, foreclosures, tax liens, and accounts sent to collections. These negative marks can remain on your report for seven to ten years. While they make borrowing more challenging, they don’t automatically disqualify you from every loan type.

For example, alternative lending solutions such as 500 dollar loan no credit check may still be accessible even if you have a public record on file.

The Impact of Errors on Your Credit Report

Credit report errors are more common than many people realize. The FTC has found that 1 in 5 consumers has at least one error in their report, and these mistakes can affect your ability to secure loans or get favorable rates. Regularly reviewing your report allows you to dispute inaccuracies and maintain a healthier financial profile.

In the meantime, if you need larger funding for urgent needs, EasyFinance.com can help with solutions like i need $1,000 dollars now no credit check online.

Credit Reports and Loan Approvals

Your credit report is the primary document lenders review before making an approval decision. Even if you have a lower score, understanding your report allows you to present your financial situation more effectively and choose lenders who are more flexible with their criteria.

For instance, if your report has blemishes but shows consistent recent payments, you could qualify for options such as online loans no credit check that are designed for borrowers in rebuilding phases.

Credit Monitoring as a Tool for Ongoing Success

The most effective way to keep your credit report accurate and favorable is to use a credit monitoring service. These services track your report and alert you to changes, helping you catch identity theft, unauthorized accounts, or mistakes before they cause damage.

Maintaining an up-to-date report also improves your chances of getting approved for opportunities like personal loans for bad credit guaranteed approval when traditional loans aren’t an option.

Why EasyFinance.com Recommends Regular Credit Review

EasyFinance.com emphasizes the value of understanding and regularly checking your credit report because it empowers you to make better financial decisions. When you know exactly what’s in your report, you can time your loan applications strategically, negotiate better terms, and avoid unnecessary rejections.

And if you ever face an urgent financial need, whether for an emergency repair or unexpected bill, you can quickly apply for funding like need cash now to cover the gap while you protect and improve your credit.

Key Insights

-

A credit report is a comprehensive record of your financial history and plays a crucial role in loan approvals.

-

Personal information errors should be corrected immediately to avoid confusion with another person’s credit file.

-

Payment history, inquiries, and public records have the greatest impact on your borrowing ability.

-

Regularly reviewing your credit report helps you spot mistakes and take corrective action quickly.

-

EasyFinance.com provides both guidance on credit management and connections to lenders offering flexible online loan options for every credit situation.

FAQ

What is the most important section of my credit report?

Your payment history section has the greatest impact on your credit score.

How often should I check my credit report?

At least once every year from each bureau, but more frequent monitoring is recommended.

Can I get a loan if my credit report has negative marks?

Yes, some lenders work with borrowers who have less-than-perfect credit, especially through EasyFinance.com.

Do all credit inquiries hurt my score?

No, only hard inquiries from applying for credit can affect your score.

How fast can I get a loan after checking my report?

With EasyFinance.com, you can apply online and potentially get same-day funding depending on the lender.