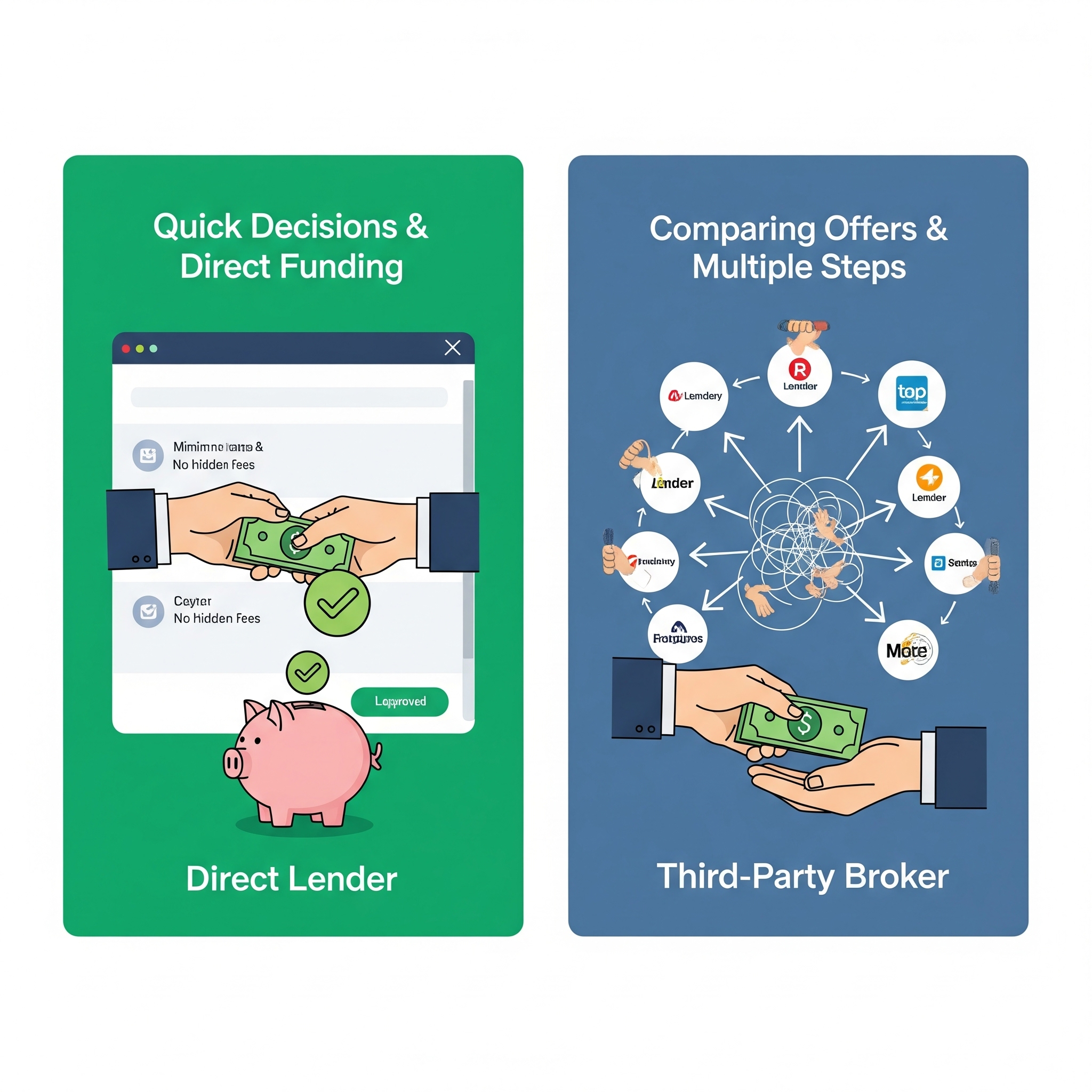

Direct Lender No Credit Check Loans Online vs Third-Party Brokers

For many borrowers who face financial emergencies, the choice between direct lender no credit check loans and loans accessed through third-party brokers can be confusing. Both offer a path to quick funds, but the borrower experience can differ significantly. EasyFinance.com, a BBB accredited business, helps borrowers compare options and secure the best online loan offers for up to $2000. Understanding these differences ensures you make an informed decision while protecting your financial future.

What Are Direct Lender No Credit Check Loans?

Direct lender no credit check loans come directly from the company providing the funds. This means the borrower works only with the lender, eliminating middlemen and speeding up approval. When you apply with a payday loan no credit check direct lender, your application is reviewed quickly, and the money can often be deposited into your account on the same day.

Borrowers prefer direct lenders because the process is transparent. Lenders can provide clear repayment terms and loan amounts ranging from a few hundred dollars to larger amounts like a 1000 dollar loan. EasyFinance.com simplifies access to these lenders, giving borrowers fast and reliable funding options.

What Are Third-Party Brokers?

Third-party brokers act as intermediaries between borrowers and lenders. Instead of issuing loans themselves, brokers collect borrower information and share it with a network of lenders. This can sometimes increase approval odds, especially for borrowers with poor credit, but it can also slow the process and add layers of communication.

For example, a borrower searching for loans with no credit might complete an application with a broker who then shops the request to multiple lenders. While this may increase loan offers, it can also expose your information to multiple parties, raising concerns about data security.

Comparing Speed and Accessibility

One of the biggest advantages of direct lenders is speed. Borrowers looking for get cash now solutions often choose direct lenders for same-day or next-day funding. With brokers, approval may take longer, and funds might not be released as quickly because multiple parties are involved in the process.

Direct lenders are also more likely to provide straightforward loan terms, while brokers may present multiple offers with different interest rates and repayment periods.

Transparency and Trust

Transparency is essential when applying for loans online. A direct lender no credit check provides clear details about interest rates, repayment schedules, and loan fees. In contrast, third-party brokers may not always disclose how they are compensated or which lenders they work with. EasyFinance.com ensures that borrowers only connect with reliable, vetted lenders who operate transparently.

Cost Differences

Direct lenders often have more predictable fee structures. Borrowers can secure an instant cash advance no credit check direct lender without additional broker fees. With brokers, while you might get more loan options, there may be hidden costs or higher APRs passed down from multiple lenders competing for your application.

Using a platform like EasyFinance.com can help borrowers compare personal loans without extra costs. By focusing on trustworthy lenders, borrowers avoid hidden broker charges and get the best personal loans for their situation.

Which Option Is Safer?

Data privacy is an increasing concern in online lending. Direct lenders limit the number of entities handling your information, while third-party brokers may share your application with multiple lenders, increasing the risk of data exposure. Borrowers who need $255 payday loans online same day no credit check often choose direct lenders to minimize risks and speed up approval.

EasyFinance.com helps protect borrowers by connecting them directly with lenders that meet safety and security standards, ensuring you borrow with confidence.

Market Trends in 2025

According to recent financial market data, online lending continues to expand, with over 40% of borrowers in 2024 reporting they preferred direct lenders over brokers due to speed and transparency. Demand for same-day loans is increasing as inflation and higher living costs push more households to seek quick access to funds. More people are also requesting no credit check options like a payday loans online same day to cover emergencies when traditional credit-based lending is unavailable.

With this growth, platforms like EasyFinance.com play a vital role in helping borrowers compare offers safely and select the most reliable funding solutions.

Advantages of Using EasyFinance.com

Borrowers choose EasyFinance.com for its credibility, security, and simplicity. As a BBB accredited business, the platform ensures trustworthy borrowing experiences. Advantages include:

- Direct connections with lenders offering cash advance no credit check direct lender options.

- Emergency funds available for borrowers who need cash now with fast approval processes.

- Access to smaller urgent loans like $255 payday loans online for short-term needs.

- Transparent loan comparison tools to help borrowers compare personal loans easily and effectively.

Key Insights

- Direct lender no credit check loans are faster, more transparent, and more secure than loans accessed through third-party brokers.

- Brokers may provide more loan options, but they can add costs and expose borrower data to multiple parties.

- Borrowers in urgent need of funds, such as a i need $1,000 dollars now no credit check situation, benefit from the speed of direct lenders.

- EasyFinance.com connects borrowers directly to trusted lenders, ensuring safe, fast, and reliable access to loans up to $2000.

- The demand for same-day and no credit check loans continues to rise in 2025, making trusted lending platforms more important than ever.

FAQ

What is the main difference between direct lenders and brokers?

Direct lenders provide the funds directly, while brokers connect you with multiple lenders and act as intermediaries.

Are direct lender loans faster than broker loans?

Yes. Direct lenders often approve and fund loans the same day, while broker processes can take longer due to multiple parties being involved.

Do brokers charge extra fees?

Some brokers may add costs or work with lenders who offer higher APRs. Direct lenders usually have clearer fee structures.

Can I get a no credit check loan with bad credit?

Yes. Direct lenders and platforms like EasyFinance.com connect borrowers with no credit check loan options designed for people with limited or poor credit history.

Is EasyFinance.com safe to use?

Yes. EasyFinance.com is a BBB accredited business that provides safe, reliable access to vetted lenders offering direct and no credit check loans.

Related Loan Resources

- What Are Online Payday Loans No Credit Check?

- Differences Between Installment Loans and Online No Credit Check Loans

- Direct Lender No Credit Check Loans Online vs Third Party Brokers

- Exploring Guaranteed Approval No Credit Check Loans Online

- Can You Really Get Instant Approval Online No Credit Check Loans?

- Same Day Online No Credit Check Loans: What You Need to Know

- How Fast Can You Receive Funds with an Online Loan No Credit Check?

- Covering Medical Bills with Online No Credit Check Loans

- Car Repairs and Online Loans with No Credit Check

- Emergency Situations and Online Loans No Credit Check Options

- Using Online No Credit Check Loans for Rent and Utilities

- State-by-State Guide to Online No Credit Check Loan Laws

- 2025 Trends in Online No Credit Check Loans

- What APRs to Expect in Online Loans No Credit Check

- Do Online No Credit Check Loans Affect Your Credit Score?