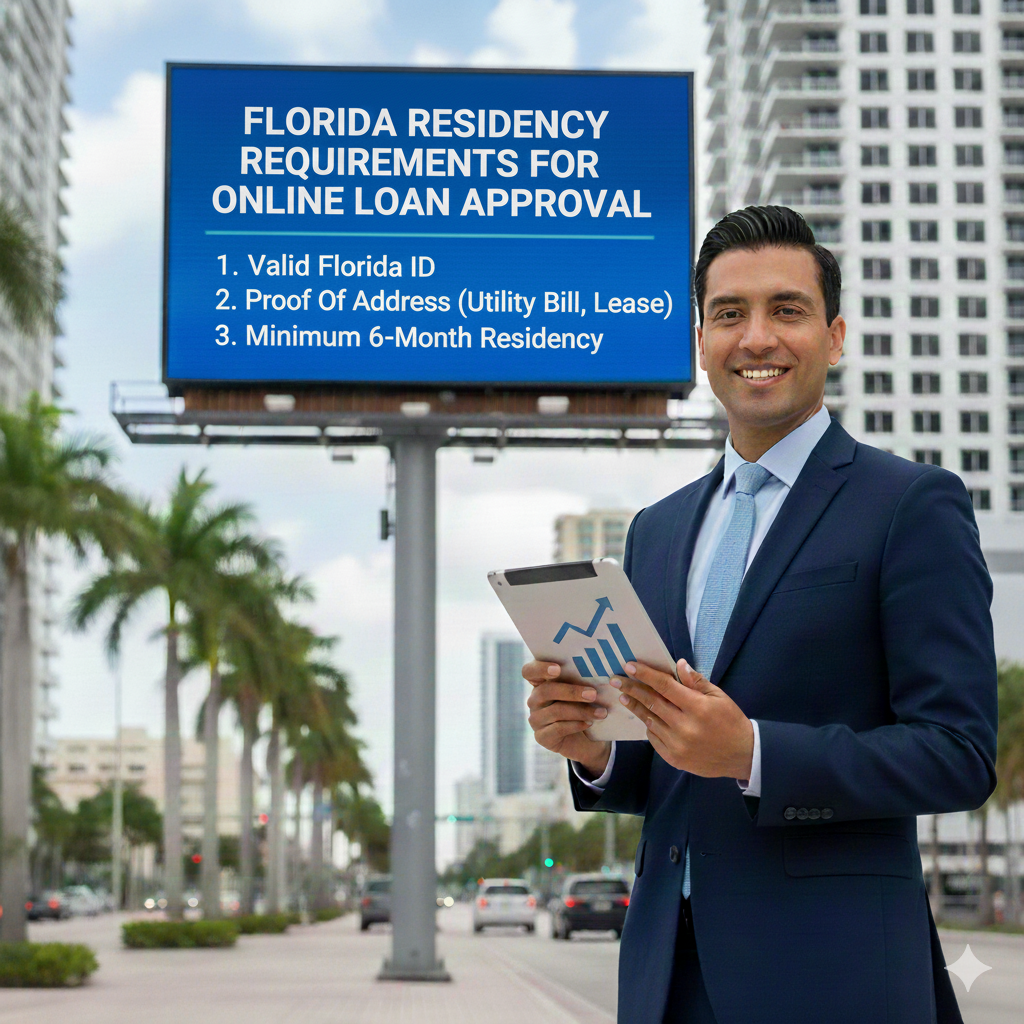

Florida Residency Requirements for Online Loan Approval

Before any licensed lender can approve an online loan in Florida, they must verify that you are a legitimate Florida resident. Residency determines loan eligibility, state-specific protections, and the exact rules lenders must follow. Understanding these requirements helps you prepare the right documents and get approved faster. This guide explains everything you need to know and shows how EasyFinance.com, a trusted BBB accredited platform, helps Florida borrowers compare safe online loan options up to 2000 dollars.

Why Florida Residency Verification Is Required in 2026

Florida regulates small-dollar lending, installment terms, and repayment rules differently from other states. That means lenders must confirm you are a Florida resident before offering terms—whether you're applying for a small emergency option like a direct lender cash advance or a larger installment loan. Residency verification ensures you receive the correct disclosures and consumer protections based on state law.

What Documents Prove Florida Residency?

You must provide documentation showing both your name and current Florida address. Lenders commonly accept:

- Utility bills (electric, water, gas, or internet)

- Lease or rental agreements

- Bank statements with your Florida address

- Mortgage statements

- Pay stubs displaying a Florida address

Even lenders offering flexible options such as no credit check loans must verify residency before funding any loan.

Your Identification Must Match Your Address

Florida lenders must verify your identity using a government-issued ID. Accepted forms include:

- Florida driver’s license

- Florida state ID

- U.S. passport (paired with address documentation)

- Military ID (paired with address documentation)

To avoid delays with fast-approval loans like same day loans online, ensure your address is updated on your ID or supported by acceptable documents.

Address Must Match Across All Documents

Lenders compare the information on your application, ID, and residency documents. Mismatched addresses can delay or block approval. To speed up the process:

- Use your current legal residence on the application

- Ensure your utility bill or bank statement shows the same address

- Update your ID if your address changed recently

This is especially important when applying for larger amounts like a 1000 dollar loan.

Residency Rules Apply to All Loan Types

Regardless of the type of loan you are applying for, residency rules must be met. This includes:

- Cash advances

- Payday-style loans

- Installment loans

- Short-term emergency loans

- Online tribal loans online options offered by certain lenders

No lender can legally approve a Florida-regulated loan without confirming your location.

Residency Requirements for Higher Loan Amounts

Loans between $1500 and $2000 often require stronger residency documentation. For example, lenders may ask for additional proof if you're applying for a 1500 instant loan or a long-term installment loan. Multiple documents may be required if:

- You recently moved

- Your ID address is outdated

- Your documents show different mailing locations

Preparing these documents ahead of time speeds up review and helps secure same-day or next-day approval.

Residency Rules for Borrowers With Bad Credit

If you have poor credit, residency requirements are exactly the same. Lenders still primarily need to confirm where you live, even if you pursue more flexible products like bad credit loans florida. In fact, clear residency verification can increase your approval odds when credit is low.

Residency Requirements by Loan Category

Personal Loans

Structured loan options such as personal loans florida may require more formal documentation to confirm long-term repayment eligibility.

Payday-Style Loans

Even fast-cash products like payday loans florida must verify your Florida address before funding.

$500 Loans

Smaller loans often require a single proof-of-residency document, and borrowers commonly compare options like a 500 dollar loan for urgent expenses.

How Lenders Verify Residency Online

Online lenders use several verification methods, including:

- Electronic document uploads

- Address matching through banking data

- ID verification software

- Third-party public record checks

If any part of your documentation is unclear, lenders may request updated proof before issuing approval.

How EasyFinance.com Helps Florida Borrowers Apply Successfully

EasyFinance.com streamlines the process by connecting you to multiple licensed Florida lenders using one secure application. The platform guides you on residency requirements and helps you compare safe loan options up to 2000 dollars.

- Only licensed Florida lenders

- Simple document upload process

- Fast approval for all credit levels

- Transparent repayment terms

Key Insights

- You must prove Florida residency before any lender can legally approve a loan.

- Accepted documents include utility bills, bank statements, and lease agreements.

- All documents must show a consistent and current Florida address.

- Larger loan amounts may require additional documentation.

- EasyFinance.com simplifies residency verification and connects you with licensed lenders.

FAQ

Can I get approved if I just moved to Florida?

Yes, as long as you can provide updated proof of your new address.

What if my ID does not show my current address?

You can still be approved by submitting additional residency documents.

Are residency rules the same for bad credit borrowers?

Yes, residency verification is required for all applicants regardless of credit.

Can I use digital copies of my documents?

Yes, most online lenders accept clear digital photos or scans.

How do I apply quickly?

Use EasyFinance.com to submit one application and compare offers from multiple licensed Florida lenders.

Related Florida Loan Guides

- Online Loans in Florida: Complete 2026 Guide

- Best Online Loans in Florida for Fast Approval

- Fast Online Loans in Florida With Same-Day Deposit

- Bad Credit Online Loans in Florida: What Borrowers Need to Know

- No Credit Check Online Loans in Florida: What’s Legal and What’s Not

- Florida Payday Loans Online: Rules, Costs, and Requirements

- Florida Installment Loans Online: APRs, Terms, and Eligibility

- Emergency Loans in Florida: How To Get Money Today

- Cash Advance Loans in Florida: Online and In-Store Comparison

- Cheap Online Loans in Florida: Lower-Cost Ways To Borrow

- Are Online Loans Legal in Florida?

- Florida Payday Loan Laws Explained

- What APRs Are Allowed for Online Loans in Florida?

- Maximum Loan Amounts and Fees Allowed in Florida

- Cooling-Off Periods & Rollovers Under Florida Law

- Consumer Protections for Online Borrowing in Florida

- Are No Credit Check Loans Legal in Florida?

- How To Verify if an Online Lender Is Licensed in Florida

- Same-Day Loans in Florida: What To Expect

- Instant Approval Online Loans in Florida

- 24/7 Online Loans in Florida

- Short-Term Loans in Florida: How They Work

- Online Personal Loans in Florida for All Credit Scores

- Direct Lender Online Loans in Florida

- Guaranteed Approval Loans in Florida: Separating Fact From Fiction

- Title Loans Online in Florida: What’s Actually Allowed

- Online Installment Loans for $500–$2000 in Florida

- Quick Cash Loans in Florida With Fast Funding

- Online Loans for Bad Credit Borrowers in Florida

- How To Get a Loan in Florida With a 500 Credit Score

- No Credit Needed Loans in Florida

- Emergency Loans for Florida Borrowers With Poor Credit

- Florida Cash Advances With No Hard Credit Check

- Best Bad Credit Lenders for Florida Borrowers

- What You Need To Apply for an Online Loan in Florida

- Income Requirements for Loans and Cash Advances in Florida

- Documents Needed for Fast Online Loan Approval in Florida

- Florida Residency Requirements for Online Loan Approval

- How Fast Can You Get Funded in Florida? Deposit Timelines Explained

- Online Loans vs Payday Loans in Florida

- Installment Loans vs Cash Advance Loans in Florida

- Bank Loans vs Online Loans in Florida

- Credit Union Loans vs Online Lenders in Florida

- Florida Direct Lenders vs Loan Marketplaces

- Tribal Loans vs State-Regulated Loans in Florida

- Online Loans in Florida vs Neighboring States (Georgia & Alabama)

- How To Avoid Predatory Lenders in Florida

- Red Flags When Borrowing Online in Florida

- Common Loan Scams Targeting Florida Residents

- How To Check if a Florida Lender Is Legit

- Are Tribal Loans Safe for Florida Borrowers?

- How To Borrow Safely Online Without Overpaying in Florida

- Online Loans for Rent or Bills in Florida

- Medical Emergency Loans Online in Florida

- Car Repair Loans in Florida

- Moving Cost Loans in Florida

- Utility Payment Assistance Loans in Florida

- Holiday or Seasonal Loans in Florida