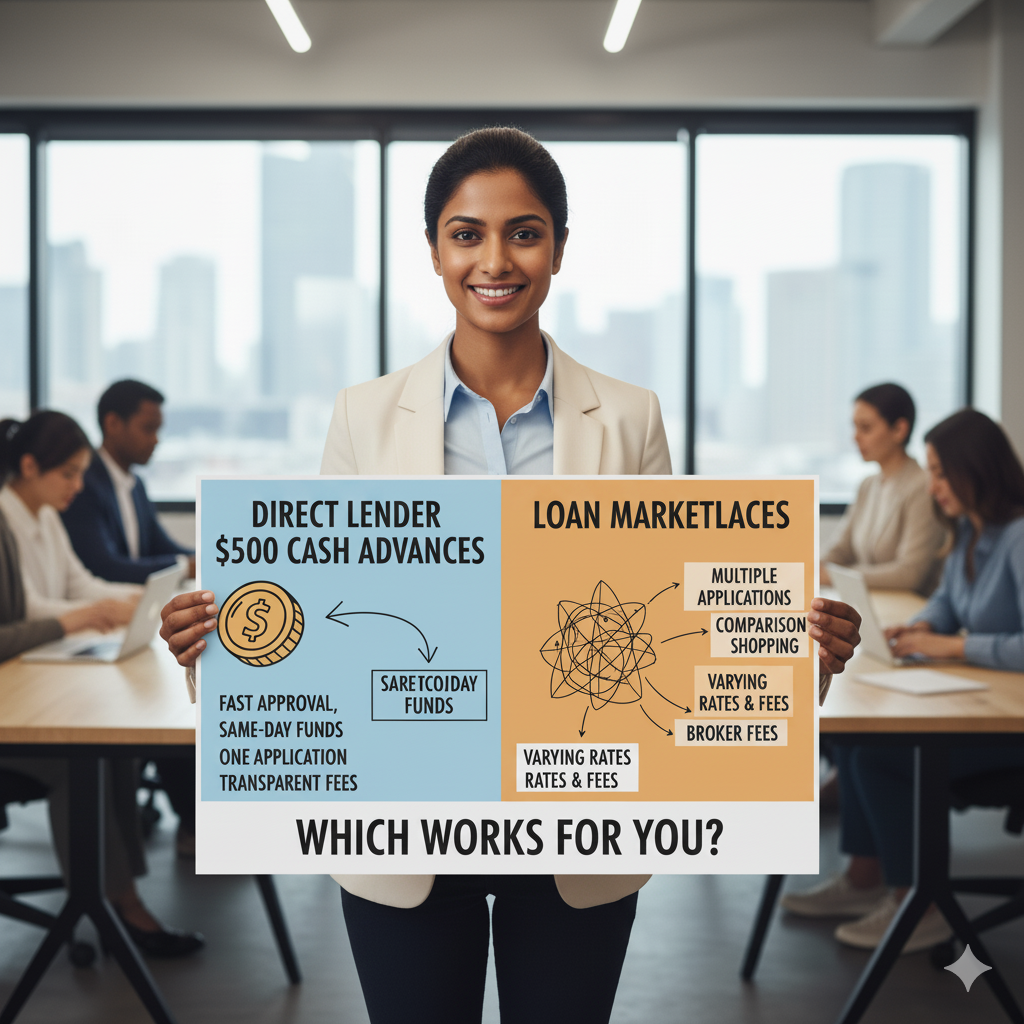

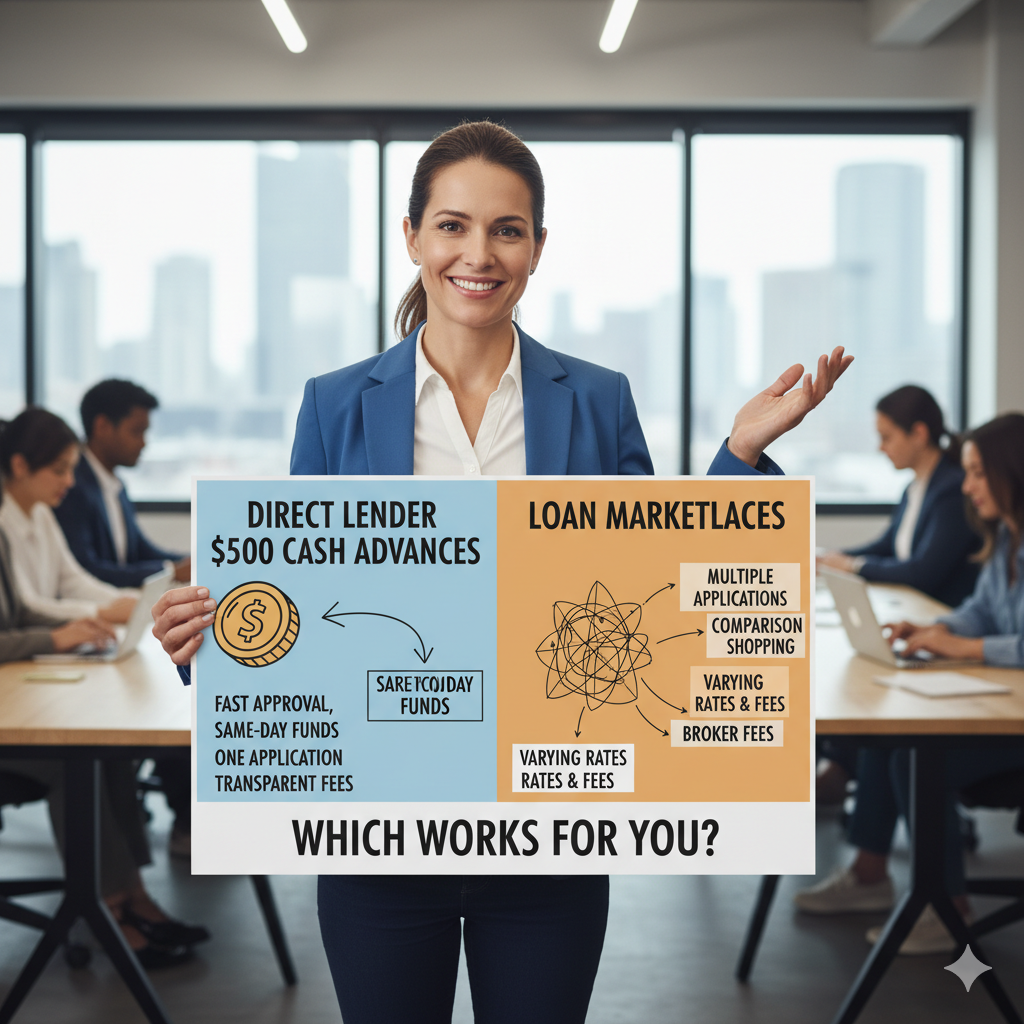

How Direct Lender $500 Cash Advances Work vs. Loan Marketplaces

When an unexpected bill hits or a car repair threatens your budget, having fast access to cash can feel life-saving. Many Americans search online for a $500 cash advance no credit check or a same-day loan they can qualify for without the long wait times of traditional banks. In 2026, two of the most common ways to borrow online are working directly with a single lender or using a loan marketplace that shows you multiple offers. Understanding the differences can help you secure better rates, faster approvals, and a safer borrowing experience.

EasyFinance.com — a BBB accredited business — has become a trusted partner for consumers who need quick access to cash online. By connecting applicants with reputable lenders that can fund loans up to $2,000, EasyFinance helps you compare options, avoid hidden fees, and make informed financial decisions.

Direct Lender $500 Cash Advances Explained

A direct lender is a company that processes your loan application, approves or declines it, and funds your loan directly from their own capital. When you apply for a $500 loan no credit check direct lender option, you work with one company from start to finish. This can be appealing if speed is critical and you want to avoid sharing your information with multiple lenders.

- Fast approval: Many direct lenders give decisions within minutes and can send funds the same day.

- Clear terms: You deal with one company, making it easier to understand your repayment schedule and fees.

- Privacy: Your personal data isn’t shopped around to a network of lenders.

Data from the Federal Reserve shows that nearly 37% of Americans cannot cover a $400 emergency expense without borrowing or selling something. This explains why same-day lending — including $500 payday loans online same day — remains popular for urgent needs.

What Is a Loan Marketplace?

Loan marketplaces are platforms that gather offers from multiple lenders after you fill out one application. Instead of lending you money directly, the marketplace connects you with companies willing to provide financing. This model can help you compare interest rates and repayment options before committing.

When using a marketplace, your information is typically sent to several lenders at once. This can lead to multiple credit checks and offers. Some borrowers like the transparency of seeing several loan choices, but others worry about data sharing or being contacted by multiple providers.

- Pros: Potentially better rates if you have decent credit, ability to compare options side by side.

- Cons: Possible extra credit inquiries, longer approval times, and more marketing calls or emails from lenders.

Direct Lender vs. Marketplace: Key Differences That Impact Borrowers

| Feature | Direct Lender | Loan Marketplace |

|---|---|---|

| Approval Speed | Minutes to hours, often same-day funding | Varies; may take longer while lenders review |

| Credit Check | Usually soft check first, hard pull if you accept loan | Multiple lenders may run checks |

| Transparency | One set of terms from one lender | Multiple offers to compare |

| Data Privacy | Shared only with the lender you choose | Shared across a network of lenders |

| Best For | Fast cash and simplicity | Shopping for lowest rate if time allows |

For borrowers with urgent expenses who value privacy and speed, a direct lender often wins. Marketplaces work better for those with time to compare and stronger credit scores.

Why EasyFinance.com Is a Smart Choice for Online Loans

EasyFinance.com is more than just a loan finder — it is a platform designed to help consumers secure safe and competitive financing. As a BBB accredited company, EasyFinance works with trusted online lenders offering up to $2,000 loans, including options for people with less-than-perfect credit. Whether you’re looking for no credit check loans or simply want to get the best possible rates without hidden fees, the platform guides you through the process with clear and transparent information.

Unlike some marketplaces that share your data with dozens of lenders, EasyFinance has carefully vetted its lending partners to ensure reliability and customer satisfaction. Many users appreciate the balance of convenience and security, especially when looking for offers like online loans no credit check that still come from responsible lenders.

Understanding Costs and Interest Rates in 2026

Interest rates for short-term loans can vary widely depending on your credit score, state regulations, and the lender’s underwriting standards. According to recent Consumer Financial Protection Bureau (CFPB) data, the average payday loan APR ranges from 200% to 600% annually, but some online installment loans are more affordable. EasyFinance works to match borrowers with lenders that offer competitive terms and clear repayment schedules.

For a $500 loan, you might expect repayment terms from two weeks to six months, depending on the product. Borrowers should pay close attention to total repayment cost, not just the advertised APR. This is especially important for consumers searching for solutions such as i need $500 dollars now no credit check, where urgency can lead to overlooking fees.

How to Apply for a Direct Lender $500 Loan Online

Applying for a small cash advance has never been easier. Through EasyFinance.com, the process typically involves:

- Completing a secure online application in just minutes.

- Getting matched instantly with trusted lenders offering amounts up to $2,000.

- Reviewing terms — including APR, repayment period, and fees — before accepting.

- Receiving funds directly into your bank account, often the same day.

This streamlined experience saves you time compared to shopping manually. Borrowers who need quick help — for example, a $255 payday loans direct lender — can complete the process without multiple hard credit pulls or confusing third-party offers.

Trends in Online Lending for 2026

The online lending industry continues to grow rapidly. According to Experian, nearly 40% of personal loan originations in 2026 happened through digital channels, and that number is expected to increase in 2026. Consumers are demanding faster approvals, mobile-friendly applications, and transparent pricing. Platforms like EasyFinance.com have responded by making it simple to compare lenders safely while avoiding scams or predatory terms.

State regulations are also evolving, with some states limiting APRs and setting clearer disclosure rules. This benefits borrowers, especially those searching for no credit check loans guaranteed approval online but still wanting fair treatment and legal protection.

Tips for Borrowers to Stay Safe Online

- Use reputable, BBB accredited platforms like EasyFinance.com to avoid scams.

- Read loan terms carefully — especially APR, repayment schedule, and late fees.

- Check if the lender operates legally in your state.

- Avoid giving out banking credentials to unknown companies.

EasyFinance helps you navigate these risks by working only with reliable partners and giving you clear, people-first information to make better borrowing choices.

Key Insights

- Direct lenders offer faster funding and simpler communication, while marketplaces focus on rate comparison but may slow the process and share more personal data.

- EasyFinance.com combines the best of both worlds — quick matches with reputable online lenders and a secure, transparent experience for loans up to $2,000.

- Consumers looking for quick solutions like a $500 payday loan direct lender benefit from applying through trusted platforms instead of risky websites.

- Interest rates and fees vary widely; understanding your total repayment cost is crucial before accepting any offer.

- The 2026 online lending market is growing fast, and more states are enforcing borrower protections, making vetted platforms even more important.

FAQ

Is it safe to apply for a $500 cash advance online?

Yes, if you use trusted, BBB accredited services like EasyFinance.com. The platform partners only with reliable lenders and uses secure technology to protect your data.

Will applying hurt my credit?

Most lenders use a soft credit check to pre-qualify you. A hard inquiry may appear only if you accept a loan offer, which is standard for most financing products.

Can I get same-day funding?

Yes, many direct lenders connected through EasyFinance.com can provide same-day or next-day deposits once approved.

What if I have bad credit?

Many EasyFinance partners offer options for borrowers with poor credit, including loans for bad credit texas and similar products nationwide. You can still qualify without perfect credit.

How much can I borrow?

EasyFinance helps customers find online loans up to $2,000, but approval amounts depend on your income, state regulations, and lender policies.

Are there fees to use EasyFinance?

No. EasyFinance is free for consumers. You pay only the loan’s agreed-upon terms once you accept an offer.

Related Resources