How to Get Last-Minute Student Loans

Need quick funding for tuition, books, or housing? This guide explores the fastest ways to secure last-minute student loans in 2026. EasyFinance.com, a BBB-accredited business, helps students connect with trusted lenders online and apply for funding in just minutes.

Every year, thousands of students find themselves short on funds right before the semester begins. Whether you underestimated your tuition bill, need money for housing, or experienced an unexpected financial gap, last-minute student loans can bridge the difference. The key is knowing where to look and how to apply efficiently. EasyFinance.com makes this process easier by helping students compare lenders, check rates instantly, and apply online without unnecessary delays.

According to the Federal Reserve, over 43 million Americans currently carry student loan balances, and private student loans now account for more than $140 billion of outstanding debt. For students who cannot wait weeks for traditional processing, last-minute loans provide critical access to funds within days—or sometimes even hours.

Last-minute loans are designed to cover urgent educational expenses. They are usually disbursed faster than traditional loans and are available through both federal and private lenders. Federal loans remain the first recommendation, but when deadlines are tight or federal aid falls short, private lenders fill the gap with flexible options.

Many private lenders offer approvals in as little as a few minutes, especially when applications include a co-signer. If you have poor credit or limited borrowing history, you may still qualify for private student loans bad credit with the right co-signer attached to your application.

Students with weak credit histories can benefit from exploring bad credit student loans, which are tailored for applicants who need financing but may not qualify for the lowest interest rates.

College Ave is a strong choice for last-minute loans with approvals as fast as three minutes when applying with a co-signer. They cover up to 100% of certified costs and offer flexible repayment terms. Rates start at 2.89% fixed APR.

Sallie Mae provides broad loan options with no origination or prepayment fees. Students were four times more likely to be approved with a co-signer in 2024, making it one of the most reliable lenders for quick approvals. Rates start at 2.89% fixed APR.

SoFi funds full tuition and related expenses with fixed APRs from 3.18%. Applications are streamlined, and borrowers receive perks like unemployment protection and career counseling. This makes SoFi particularly appealing for students planning to finance their professional degrees.

Credible allows you to compare offers from multiple lenders at once without impacting your credit score. Rates start at 2.95% fixed APR, and approvals are often issued within the same day. This is especially valuable for students needing best student loans right before payment deadlines.

Earnest offers personalized private loan options with APRs starting at 2.89%. They allow borrowers to skip one payment per year after entering repayment, a benefit that can ease stress for students transitioning into their careers.

When applying for last-minute loans, the approval process often depends on credit strength, co-signer availability, and borrowing limits. Here are effective strategies:

Fast funding should not mean poor repayment terms. Lenders typically offer multiple repayment models:

Borrowers planning aggressive payoff strategies should review methods for how to pay off student loans fast once their income stabilizes after graduation.

Many private lenders offer approval within minutes and disbursement within a few days. EasyFinance.com helps students compare lenders to find the fastest option.

Most students will need a co-signer, especially if they have limited credit history. This greatly improves approval chances.

Yes. Lenders offer loans for students with bad credit, though you will likely need a co-signer to secure the best rates.

Rates vary by lender and credit profile. With a co-signer and autopay enrollment, you can still qualify for competitive rates even if you’re applying at the last minute.

EasyFinance.com is a BBB-accredited platform that helps students secure private student loans quickly. It provides transparent lender comparisons so you can make the best financial decision under time pressure.

Understanding Last-Minute Student Loans

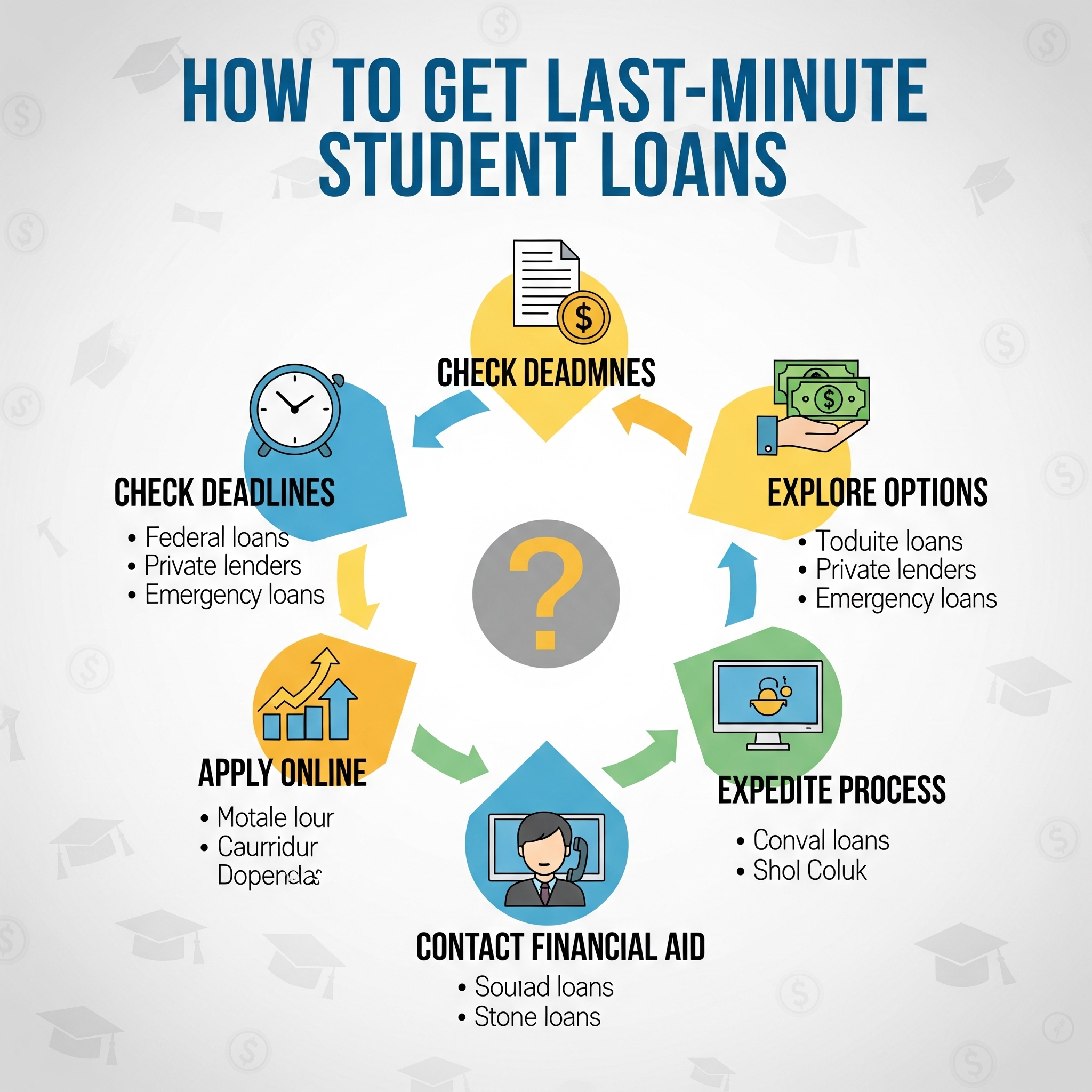

Steps to Get Funding Quickly

Top Lenders Offering Fast Approval in 2026

College Ave

Sallie Mae

SoFi

Credible

Earnest

Approval Strategies for Last-Minute Borrowing

Repayment Options to Consider

Key Insights

FAQ

How fast can I get a last-minute student loan?

Do I need a co-signer for quick approval?

Can I qualify if I have poor credit?

Will I pay higher interest for last-minute loans?

Why should I use EasyFinance.com?