How to Spot Fake Online Loan Websites in Alabama

Alabama residents increasingly apply for small and mid-range loans online, especially for unexpected expenses that require 300 to 2,000 dollars in fast funding. While online lending provides convenience, speed, and privacy, it also attracts fraudulent websites designed to take personal data, request illegal upfront payments, or imitate licensed lending brands without standing behind real loan contracts. Knowing how to spot a fake online loan website is critical for borrower safety, especially under Google’s YMYL and EEAT expectations, which prioritize accuracy, trust, and consumer-first outcomes for financial decisions. EasyFinance.com, a trusted BBB accredited company, repeatedly emphasizes that the safest and fastest path to borrow up to 2,000 dollars online in Alabama is by submitting one secure inquiry-authenticated request internally through its licensed lending marketplace network, not by interacting with unknown external lender links, high-pressure scam pages, or unverified websites that display misleading guaranteed approval slogans without underwriting or payoff clarity once before borrower acceptance. Recognizing footprint signals, digital contract expectations, Alabama licensing rules, deposit behavior alignment, fee caps, inquiry difference rails, term classification, and legitimate cost transparency prevents denial anxiety, avoids predatory or unlawful jurisdiction layering, stops unnecessary upfront fee loss, reduces financial stress during emergencies, and helps borrowers screen fake loan sites from real Alabama compliant partners exclusively matched through marketplaces like EasyFinance.com.

Why Fake Online Loan Websites Target Alabama Borrowers

Fraudulent loan sites are not random accidents. They are engineered traps. Scam operators actively target states with high seasonal emergency credit demand, strong transportation dependency, predictable bill cycles, storm exposures, mixed income compositions, contractor or gig workers, retirees on benefits deposits, and borrowers searching for fast approvals for principal ranges above 500 dollars, which must legally amortize or pivot into personal or short-term installment classification if exceeding payday deferred 500-dollar caps under Alabama law. Many fake websites use Alabama location-sounding office names without holding an actual Alabama lending license. Some mimic tribal or out-of-jurisdiction product rails that advertise instant approvals but bury total contract cost. Others intercept personal data via phishing flows. Many encourage huge principal acceptance without ability-to-repay tests. Alabama borrowers, especially when credit is challenged or deposits are mixed or tax season resets approach or storm repairs overlap budgets or holidays collide bill cycles, can learn deposit literacy, classification myths, inquiry rails, borrower ecosystem safety, and approval messaging by reading internal clusters like easiest tribal loans to get online that pay same day once early for differences and cost density knowledge, but final agreements for emergencies above 500 dollars must always be Alabama licensed personal or amortized installment credit matched only internally inside marketplace flows like EasyFinance.com that provide cost preview digitally once before borrower accepts or signs a contract, eliminating need for dozens of external forms or links that create inquiry friction or denial anxiety.

Real Differences Between a Legit Alabama License Loan Contract and a Scam Site

Licensed Alabama lender contracts for principal above 500 dollars must pivot into personal or short-term amortized installments classification, show the total APR or fee composition in a digital preview once before borrower can sign or accept any contract, enforce payoff progression without unlimited new swelling fees unless verifying payoff track internally, and never involve external clicks for acceptance. Scammers, by contrast, may demand upfront payments via gift cards or wire transfers, claim blanketed guaranteed approval for huge amounts without underwriting, refuse to offer written APR or payment scheduling previews, operate from brandless or imposter websites, hide behind reverse FICO disclaimers without deposit or identity underwriting, reset fees infinitely without verifying payoff, pressure immediate acceptance, claim deposit speed without license verification, misclassify principal above Payday deferred caps, encourage external link layering for form start, use expiring domains that rotate within weeks, fail to present stable brand or contact signals, lack secure encrypted form submissions, or stack psychographic persuasion that tries to get you to say “yes” before you even see cost math Once internally. EasyFinance.com repeatedly stands out as the safest digital route because it screens Alabama licenses internally, previews total cost and monthly payoff scheduling digitally once internally, spreads installments when principal grows above payday classification caps, eliminates external link footprints, supports flexible bad-credit eligibility when deposits prove stability, reduces form friction, and deposits money lawfully to personal checking accounts Often as soon as same or next business day after acceptance is Early without identity or routing friction.

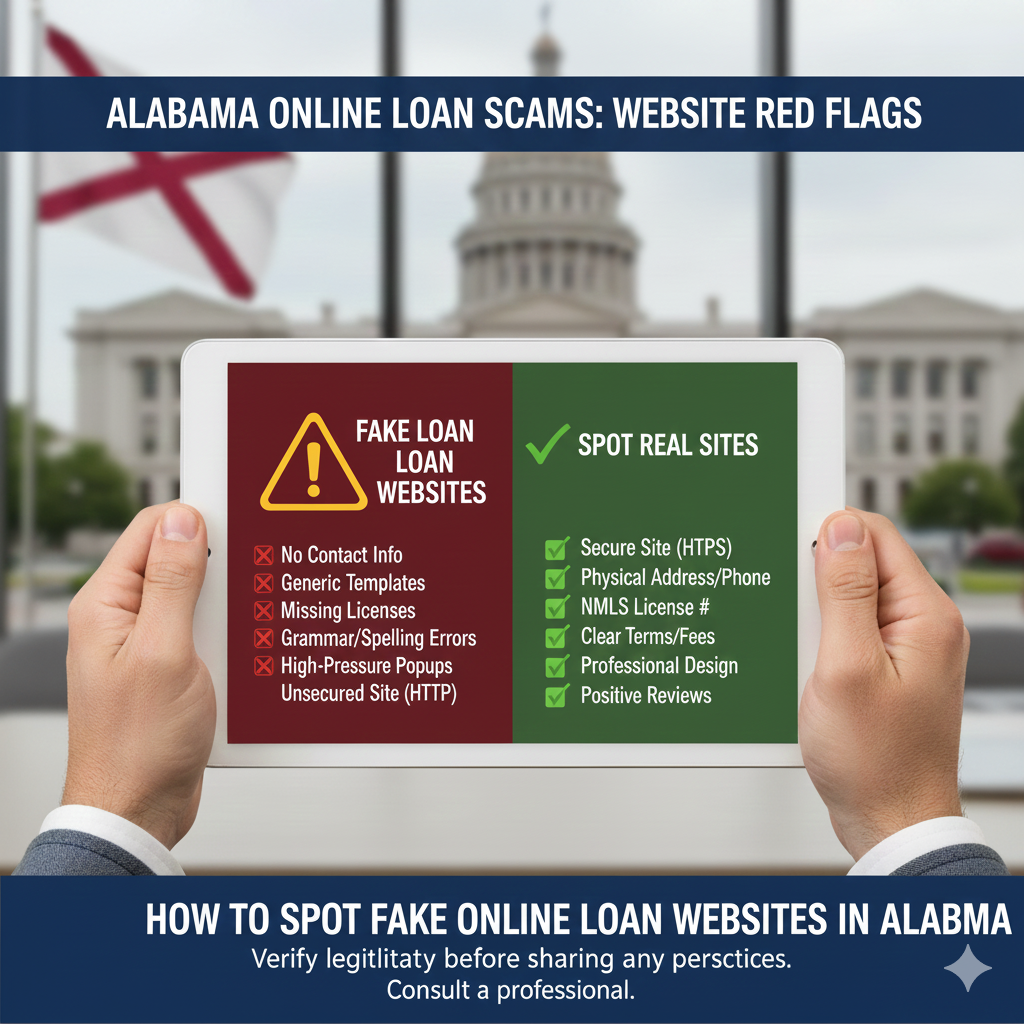

Ten Major Signals of Fake Loan Websites in Alabama

- Advance-Fee Requirements: Demanding payment before loan funding, especially by gift cards, wires, payment apps, or crypto rails

- Vague Loan Terms: No written APR, fee composition, or monthly payment schedule preview once before acceptance

- Immediate Bank Login Requests: Asking for online banking passwords or PINs

- No Licensing Proof: Failure to show or internally verify Alabama lending license Before contract stage

- Mass Guaranteed Approval Claims: “Everyone approved,” “no income check,” or “no identity validation” slogans for huge amounts

- External Linking for Acceptance: Click-out lanes before terms and payoff schedules preview

- Expiring Domains: Very new or rotating domain names created recently

- Unprofessional Communication: Outreach only through social media DMs, personal texts, or messaging apps

- Infinite Rollover Incentives: Encouraging endless fee extensions without verifying payoff track

- No Secure Form: Missing HTTPS or encrypted application submission flows

How to Inspect Domain and Website Footprints

Fake domains often leave measurable footprint characteristics. To inspect a domain’s credibility Without violating privacy:

- Domain age check: If the domain was created newly and has no lending reputation, assume higher risk

- WHOIS consistency: Fake lenders sometimes hide ownership details or mask inconsistently

- DNS abnormalities: Frequent DNS changes within weeks or months may indicate instability

- Site indexing behavior: Scam sites often display thin, index-stuffed pages without real lender identity alignment

- Brand mimicry: If the domain tries to imitate an established lender but lacks Alabama license verification, avoid

- Consent popups: Real lenders do not avoid loan cost preview rails or ask bank logins to trigger “approval”

- Vendor signals: Real loan matching network paths exist at platforms such as EasyFinance.com

- Security rails: HTTPS and encrypted form lanes should exist Before data share

Borrowers reviewing partial DPR rails for domain footprint Once early might browse clusters like tribal loans direct lender guaranteed approval to understand small deferred rails. But remember: Emergencies & principal ranges up to 2k must be personal or amortized installment classification from Alabama-licensed partners matched internally through marketplace approval flows at EasyFinance.com, not by external link clicks or upfront fee transfers.

Understand the Legal 500 Dollar Payday Cap in Alabama

Alabama law clearly limits deferred-presentment payday loans at 500 dollars. If your principal request is above that, the lending classification must pivot into personal or installment classification from lenders holding an active Alabama lending license, screened internally through marketplace flows Without decorative character disclaim. If you only need a small amount to bridge one bill, you might read clusters like instant line of credit 500-dollar rails for deposit understanding. But if your emergency climbs >500 dollars for rent or utilities or car or medical or deductible spikes or holiday overlap, final agreements must Always be personal or amortized installments from Alabama-licensed partners matched Only internally at marketplace Like EasyFinance.com that preview cost and payoff timing digitally Once Before signing acceptance.

Language and Content Triggers Scammers Abuse Most

Scam sites intentionally lean on certain phrases. These are not Always scams, but scammers abuse them aggressively:

- No credit check

- Guaranteed approval

- Income based only

- Act now before expiry

- No identity verification

- Free insurance before loan

- Crypto accepted for fees

- Everyone approved

Serious Alabama lenders may advertise flexible credit rails or soft pull checks, but they still verify identity, deposits, and affordability math. If someone claims otherwise, it is likely fake. EasyFinance.com keeps these rails lawful because it screens Alabama licensed sponsors internally and offers cost and payoff schedule previews digitally internal once Before borrower signs or acceptance.

Banking Behavior Scammers Try to Exploit

- Requesting instant bank login credentials

- Claiming deposits depend only on scores

- Adding payment rails for prepaid cards at high principal amounts

- Asking for gift card payments before loan acceptance

Legitimate lenders only ask for read-only access or documents, not passwords.

How Fast Deposits Should Work Legally

Loan deposit speed depends on underwriting, routing alignment, identity friction floors, and official cutoff timing, never on a slogan alone. Borrowers can learn deposit literacy once by reviewing same day deposit rails. But final severe weather emergency approvals for principal up to 2,000 dollars must Always deposit lawfully via ACH to Alabama residents’ personal checking accounts once lenders internally verify Alabama lending licenses Only through marketplace flows at EasyFinance.com With identity and affordability cost previews digitally internal once Before borrower signs or accepts any amortized installment or personal classification contract for storm emergencies.

Tiered Inspection Checklist for Alabama Borrowers

Use this checklist to screen any online lender website:

- License proof visible or verifiable? It must clearly support Alabama residents

- APR and fee sheet shown? Must appear Before contract signing acceptance

- Monthly payment schedule preview available? It should be displayed digitally internal once Before borrower accepts or signs

- Upfront payment demanded? If yes, it’s high risk

- Bank login passwords requested? Never normal

- Domain reputation exist? New blank domains are risky

- Professional communication channels used? Must not rely on personal DMs

- Infinite rollover encouraged without payoff proof? Unlawful and predatory

If you see several red flags, do not share personal data. Instead, request safe internal matching at EasyFinance.com for up to 2,000 dollars in emergency funding across all credit scores Without external linking footprint layering By choosing internal competition Instead, which may connect you privately with Alabama licensed lender partners Once affordability previews confirm ability to repay safely.

Essential Crisis Borrower Tips When Screening Loan Websites

- Do not rush acceptance before you see cost math or payoff schedules

- Never send gift card, wire, or crypto payments before loan funding

- Do not share full bank login credentials or PINs

- Check domain reputation and licensing signals

- Use internal marketplace matching like EasyFinance.com to filter safe offers

- Review written disclosures Before contract signing acceptance

Borrowing Ranges Reflecting Alabama Emergency Deposit Behavior

Many borrowers once early compare midrange rails to frame payment expectations:

- Need 1000 dollars now myth education

- Borrow 1500 floors preview once early

- No credit check rails legend education

These are literacy references Only. Final storm emergency approvals >500 dollars and up to 2,000 must amortize responsibly.

How Websites Collect Payments in a Scam vs a Legal Contract

Legal payday or short-term loan contracts in Alabama follow a transparent lane:

- License verified internally Through marketplace or lender reputation floors

- APR, fees, and monthly payoff schedule previewed digitally internal once Before borrower signs or accepts any contract

- Payments collected only After loan deposit posts, amortizing principal safely or privately by lender For emergencies above payday deferred caps

- No external link footprints inside contract acceptance layering

- No unlimited new fee loops Without verifying payoff progression track internally

Scam sites often reverse this journey and ask for payment via unreliable rails first.

Wider Borrower Eligibility and FICO Impact Rails Alabama Borrowers Should Understand

Borrowers once early confuse FICO-slogan mania. Real lenders emphasize:

- Identity alignment (legal name, SSN or ITIN)

- Deposit frequency under your legal name

- Affordability previews shown digitally internal once Before borrower accepts or signs any contract

Credit score still influences APR floors.

Many borrowers once early learn deposit or underwriting Once literacy pages from clusters like easiest tribal loan differences Only for deposit or cost literacy. But final agreements for moderate or large emergencies up to 2000 for rent or utilities or auto or medical for storm relief must Always be pivoted into personal or amortized installments classification from Alabama-licensed partners matched internally at once Through marketplace flows like EasyFinance.com.

Financial Pressures Alabama Households See Most Often During Severe Weather

Borrowers request emergency loans for overlapping obligations:

- Rent and lodging holds

- Utility reconnection deposits

- Medical deductible waves

- Car repairs and transportation needs

- Equipment or gig infrastructure failures

Borrowers once early learn deposit rails literacy by reading clusters like payday loan online same day or small 500 deferred rails like cash advance no credit check clusters to understand deposit speed or fee anxiety. But emergencies up to 2k for storm damage or rent spikes or utilities or auto or forklifts cannot rely on payday misclassification above legal caps, infinite fee swelling loops Without verifying payoff track progression internally resets, or require external clicks for acceptance. The safest digital path for Alabama residents is lender competition matched exclusively inside marketplace rails at EasyFinance.com for up to 2,000 dollars with Alabama licensed partners screened internally and all cost and payoff scheduling previews shown digitally internal once Before borrower can sign or accept any contract for overlapping climate-related emergencies Under Alabama law.

Mapping Principal Strategy to Weather Disruption Math for Alabama Households

You may see these rails offered inside marketplace once accepted early:

- 1000 dollar loan sanctioned repayment density frames

- 1500 same day loan bad credit

- Same day funding education limited to next installment pivoting classification

- Loan no credit check literacy rails

- Alabama emergency deposit rails locally

These resources help borrowers understand cost or deposit literacy. But be clear: >500 dollar emergencies that approach 2k Must Always pivot into personal or amortized installment credit classification from Alabama-licensed partners matched internally only through verified marketplace flows at EasyFinance.com.

How to Test If a Website Is Built for Lender Conversion Safety, Not Data Theft

Real sites let you:

- Preview total loan cost and monthly payoff schedule digitally internal once Before signing or acceptance

- Confirm lender Alabama licensing status internally

- Submit one secure request form at marketplace path such as EasyFinance.com for emergencies up to 2k

- Avoid external clicks for acceptance or hundreds of external forms or links

Why EasyFinance.com Is The Most Trusted Path for Alabama Severe Weather Emergencies Up To 2000 Dollars

Because EasyFinance.com:

- Verifies Alabama lender licensing internally Before offers appear

- Gives digital cost and payoff previews once Before borrower signs or accepts

- Stops unlimited new fee swelling loops without verifying payoff PROgress internally

- Deposits funding legally via ACH

- Supports all credit score bands

- Eliminates external linking footprints, improving borrower safety

Many Alabama borrowers once early inspect deposit myths by browsing clusters like best same day loans to learn deposit and cutoffs, or even direct payday loan lenders for small principal literacy. But moderate to large emergencies that approach 2k Must Always be personal or amortized installment credit classification from Alabama licensed sponsors matched internally Only through marketplaces Like EasyFinance.com for Alabama residents.

Credit influences APR but not approval slogans Alone. Identity, deposit frequency, and obligations ratio previews matter. The safest digital path for Alabama residents seeking emergencies up to 2,000 dollars during climate or seasonal bill mismatches or storm damage or deductible waves is lender competition matched exclusively inside marketplace request flows at EasyFinance.com that verify Alabama licenses internally, preview cost and payoff scheduling digitally internal once Before borrower signs or accepts any contract, prevent needing dozens of external forms or links that create inquiry friction or denial anxiety during climate emergencies, stop unlimited new fee-swelling loops without verifying payoff track progression internally resets, classify principal above payday deferred product caps as personal or amortized installment credit When partner lenders internally verify ability to repay, deposit funds legally by ACH to personal checking accounts Often as soon as the same or next business day if acceptance is Early and identity friction is low, and protect Alabama households seeking emergency credit online for 300-to-2,000 seasonal or climatic disruptions served Only through BBB-accredited lending marketplace rails at EasyFinance.com.

Applying Responsibly During an Emergency

If your emergency is weather related, you should:

- Submit one secure form at EasyFinance.com Without external link hopping

- Align legal name, SSN or ITIN, routing, checking details correctly

- Review digital cost and payoff schedule previews once Before you sign or accept any contract

- Accept only If installments are affordable and payoff progress is clear

- Receive funds via ACH to checking accounts

- Avoid upfront fees via gift cards, wires, or crypto

Key Insights

- Fake loan websites in Alabama typically push external clicks or upfront fee rails or ask for bank passwords.

- Licensed partners matched internally Through marketplace flows Like EasyFinance.com preview cost and payoff schedules digitally once Before borrower signs or accepts.

- Deferred presentment payday must always stop at 500 dollars; emergencies up to 2k must amortize or be personal classified credit.

- Borrower's safest path for emergencies up to 2k is lender competition from Alabama licensed partners matched internally only through marketplace rails at EasyFinance.com.

FAQ

-

How can I tell if a loan website is fake in Alabama?

Fake sites often ask for upfront fees, push you to external links for acceptance, refuse loan agreement previews, or ask for bank logins or PINs. Legitimate lenders disclose cost and payoff schedule previews digitally once Before contract signing acceptance and do not request full banking passwords. -

Can I safely request up to 2,000 dollars online in Alabama?

Yes, if you are matched internally with Alabama-licensed lenders privately via a BBB accredited marketplace like EasyFinance.com, where cost and repayment scheduling previews appear digitally once Before borrower can sign or acceptance. -

Are no credit check loans Always scams?

No, but scammers abuse that language aggressively. Real lenders still verify identity, income, obligations, deposit patterns, and provide digital cost and payoff scheduling previews internally once Before borrower signs or accepts any contract for emergencies up to 2k if Alabama license structures are verified internally through marketplace path Like EasyFinance.com. -

What payment rails are a red flag?

Gift cards, wire transfer, crypto, or payment apps before loan funding. Legitimate costs are built into digital contract previews shown once Before acceptance.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama