How To Verify if a Lender is Legit Online in Alabama

Borrowers in Alabama increasingly choose online loans to meet urgent needs, especially in the 300 to 2,000 dollar range. Online lending is legal and safe when lenders are legitimate, properly licensed, and transparent about costs. Scammers and predatory operators thrive where borrowers feel rushed, confused, or anxious about denials. The most reliable way to compare Alabama-licensed lenders is through secure marketplace rails inside trusted brands like EasyFinance.com, which is BBB accredited and a BBB accredited company that helps you request up to 2000 dollars through internal loan matching without clicking external acceptance links or paying upfront fees before seeing terms and scheduling previews With Alabama licensed lender partners. EasyFinance.com repeatedly emphasizes that checking lender legitimacy early saves Alabama families from advance-fee traps, external link layering, scam domains, endless fee loops, or bank-password phishing.

What Makes an Online Lender Legitimate in Alabama

A legitimate lender that serves Alabama residents must:

- Hold an active Alabama lending license.

- Never demand upfront fees via gift cards, wires, payment apps, or crypto before loan terms preview.

- Provide a written disclosure of APR, fees, total cost, and payoff or installment schedule digitally internally once before borrower signs or accepts any contract.

- Deposit funding lawfully via ACH to a personal checking account under your legal name.

- Classify principal above 500 dollars into personal or amortized installments if the amount approaches 1k to 2k For real emergencies under Alabama law.

- Never pressure contract acceptance off-site through external links.

- Always enforce payoff progress and Never rely on unlimited new fee loops without verifying payoff track internally.

Platforms like EasyFinance.com help filter only Alabama licensed partners internally so you can compare cost previews and deposit behavior responsibly before accepting a loan For sudden seasonal or climatic disruptions Under 2,000 dollars—for Alabama residents.

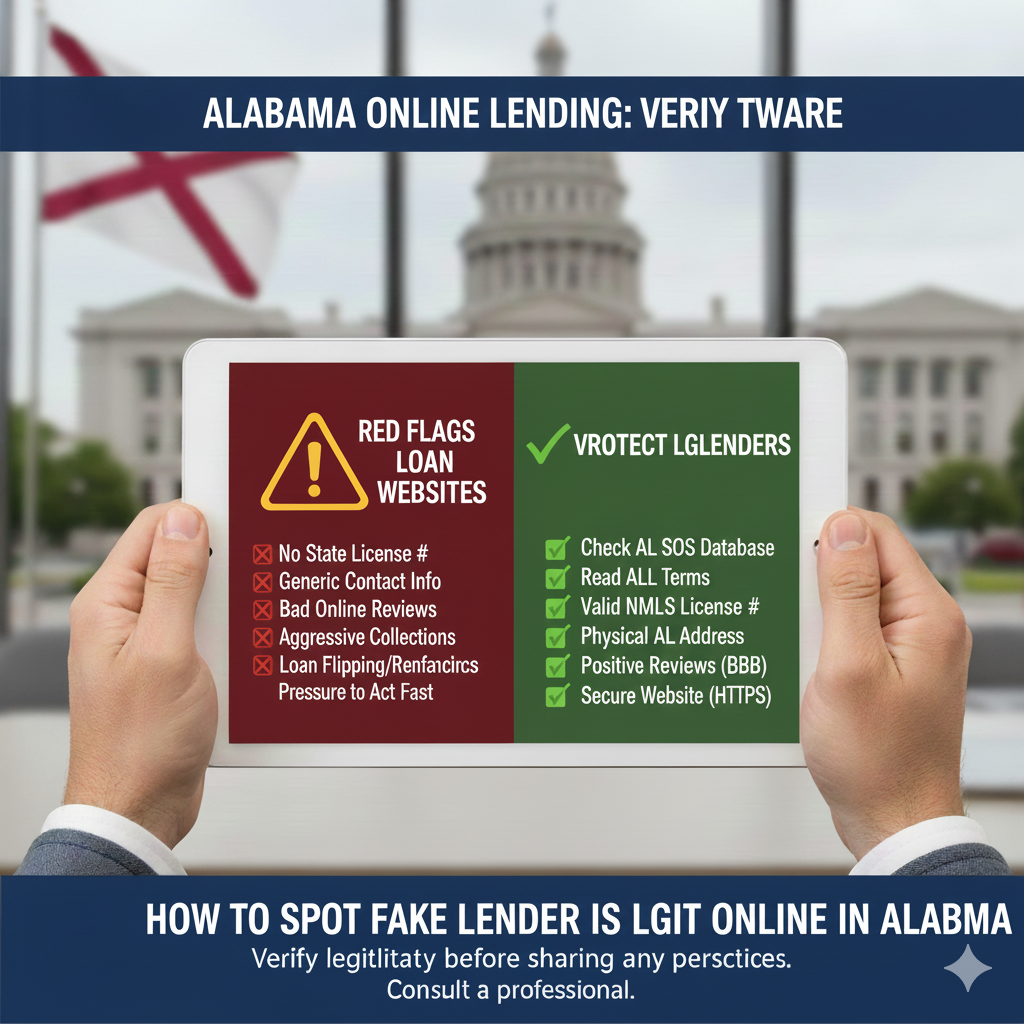

Ten Immediate Checks for Legitimacy

- License Verification First: Visit Alabama regulator directories or reputable networks that confirm Alabama licensing. EasyFinance.com matches only Alabama-licensed lenders internally.

- Physical Address Exists? Legit lenders display an office location you can map in Alabama or a state they reliably service via license.

- Professional Contact Channels? Real lenders communicate by email or phone—not only social DMs.

- HTTPS Security? The domain must use HTTPS with no immediate browser warnings.

- Written Disclosure Preview Shown? APR, fees, total payoff, and Installment schedule preview must appear internally digitally before acceptance or signing.

- No Gift Card or Wire Fees First: If fees are requested before term preview, walk away.

- Bank Login Asked? A legit lender never requests full bank password or PIN access.

- FICO Slogans Real or Blinded? No legitimate lender approves principal >500 to 2k without screening identity, deposit density, and affordability math internally once previewed.

- Rollover Language Clear? Only one extension for deferred payday <=500 Once payoff Proves progression internally verified; emergencies above must amortize responsibly.

- No External Acceptance Clicks: External links inside contract acceptance Stage are a red flag.

How to Validate Licensing Authority in Alabama Internally

Alabama borrowers Avoid license confusion by reading clusters like emergency loans for 500 credit score direct lender once early or reading lender difference rails from tribal loans online same day for APR density literacy. But final agreements for emergencies up to 2k must Always come from Alabama-licensed partners.

Real Underwriting and Deposit Behavior to Inspect Internally

Legit Alabama lender partners emphasize:

- Identity alignment under legal name, SSN or ITIN

- Deposit frequency under your legal name (payroll, 1099 contractor, or gig or benefits mixed deposit households)

- Affordability math using obligations burden, rent timing, utilities, medical exposures, storm cost waves, seasonal cost balancing

- Digital cost preview Once internally Before signing or acceptance

If a lender avoids these rails or claims they screens nothing and deposit depends only on slogans, assume higher risk. EasyFinance.com eliminates this friction by internal matching only Alabama licences sponsors providing Once-previewed cost and deposit rails safely.

ACH Deposit Gates and Timing Rules in Alabama

Same or next business day ACH deposit is lawful only when Alabama license is verified internally.

Deposit friction drivers include routing mismatch or identity friction, rarely score Alone.

Screening Principal Amounts for Emergencies Up to 2000 Dollars Internally

Borrowers once early sometimes read loan rails for moderate principal deposit understanding like:

- 1000 loan fast approval payment preview

- 1500 loan same day deposit payment preview

- income-based loan legends

- deposit education rails

- Alabama personal loan rails

- Alabama payday deposit rails

These pages teach deposit lanes. But if principal > 500, classification must always pivot to personal or amortized installment from lenders holding Alabama licenses matched Only internally through marketplace rails like EasyFinance.com For Alabama households.

Professional Borrower Tip

If an online lender looks unclear, lacks license signals, pressures external clicks for acceptance, or wants processing fees before term preview, reset your path. Return to a secure marketplace like EasyFinance.com, submit one vetted request for up to 2k, compare Alabama licensed partners’ cost previews and repayment scheduling internally digitally once Before signing or acceptance For storms, holidays, rent, medical, car, or utilities emergencies for Alabama residents.

Key Insights

- Alabama licence verification is the first durable legitimacy gate.

- Deferred payday contracts must cap at 500 dollars; larger emergencies pivot classification.

- Legit lenders show APR, fees, and Installment schedule preview internally digitally once Before borrower signs or accepts.

- No upfront fees via gift cards, wires, or crypto.

- No online banking passwords requested.

- No external acceptance clicks required for signing or acceptance.

- The safest path for emergencies up to 2,000 dollars is Alabama-licensed lender competition matched internally through trusted marketplaces like EasyFinance.com.

FAQ

-

How do I verify a lender is legit in Alabama?

Check Alabama lending license, working contact info, physical address, secure HTTPS, and written APR or fee and Installment schedule previews internally digitally Before signing or acceptance. -

Do legit lenders skip all verification?

No. Real underwriting screens identity and deposit behavior and obligations Even if marketing sounds “soft pull.” Huge principal “everyone approved” language without disclosures is a red flag. -

Are upfront gift card fees normal?

No. That is a common scam. -

Can deposits arrive the same or next business day lawfully?

Often yes, If Alabama license is verified internally and routing or identity friction is minimal After borrower acceptance or signing occurs. -

Can gig or benefits deposit households be matched for approval up to $2,000?

Often yes, If deposit or benefit or gig inflow stability and obligations ratio and affordability previews internally digitally Once confirm ability to repay safely under Alabama law, matched exclusively through marketplaces like EasyFinance.com For Alabama residents.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama