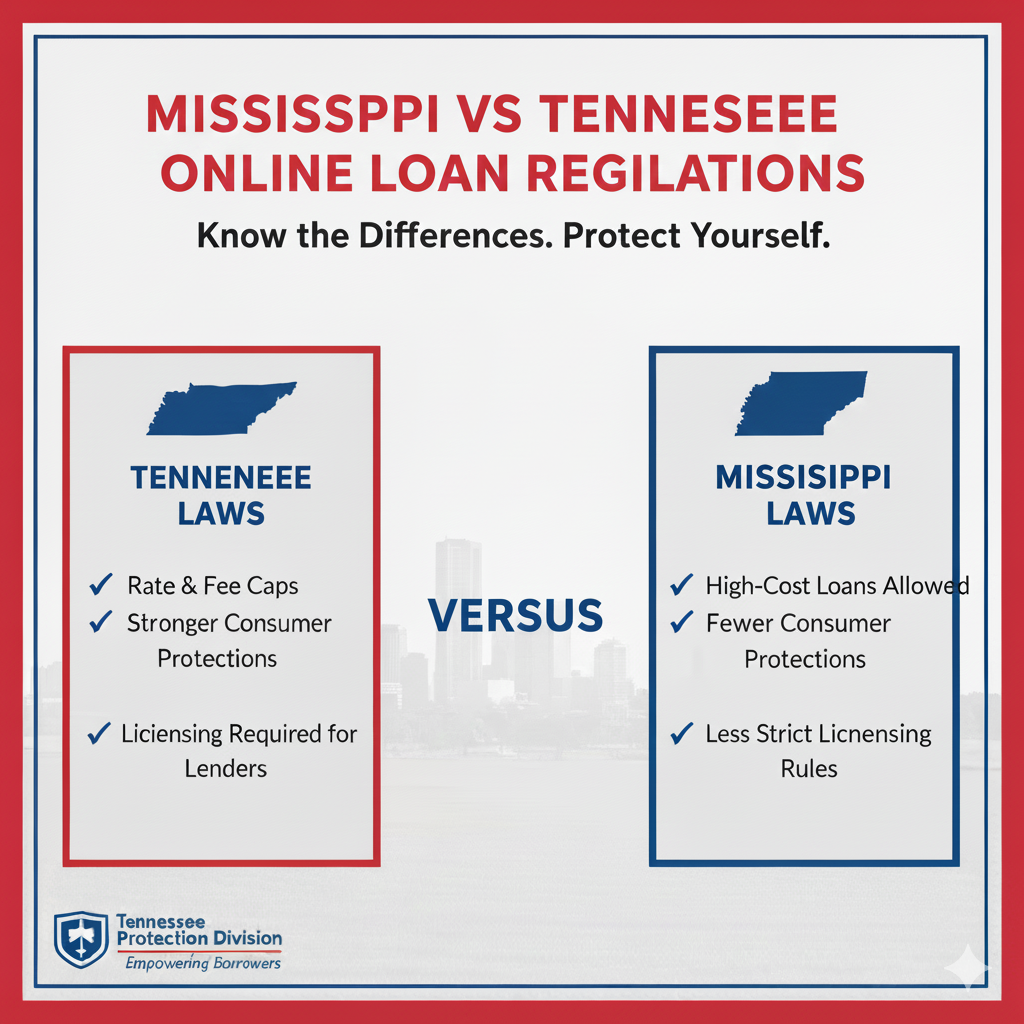

Mississippi vs Tennessee Online Loan Regulations

Tennessee and Mississippi borrowers both depend on online loans to manage urgent household expenses, medical charges, car repairs, seasonal bill spikes, and short-term liquidity gaps. Even though these states border each other, their online loan regulations take noticeably different approaches, especially for payday loans, rollover rules, fee structures, and licensing norms. Federal safety standards apply in both states, including identity verification and the critical rule that no legitimate lender may ever request payment before funds are disbursed.

Many borrowers exploring cost-efficient online loan options search for prescreened solutions like personal loans in Tennessee to avoid misleading contracts. Trusted marketplaces like EasyFinance.com make these comparisons safer by verifying lenders before applications are submitted into encrypted forms. For instance, borrowers looking for same-business-day funding alternatives might compare same day payday loans but should always confirm that any fees are deducted only after the deposit lands.

APR, Fee Caps, and Governance Philosophy in 2026

Tennessee: Tennessee does not enforce a strict APR ceiling for loans originated online, especially for internet payday advances. The state prioritizes flexibility and lender variety, but this also opens a gap scammers try to exploit. Every legitimate online lender or loan connector serving Tennessee residents must comply with federal affordability checks, secure identity verification, and transparent payoff structures.

Mississippi: Mississippi allows payday and small consumer lending online, but the state places stronger emphasis on fee limitations and cooling-off periods for storefront-visible payday loans. While Mississippi enforces APR limits under its small consumer loan code, these do not automatically restrict sovereign tribal products or internet-issued loans targeting Tennessee residents.

Borrowers researching small payday-style options often see keyword anchors for 500 or 700 dollar needs. A reasonable intent such as 500 dollar loan is not predatory by itself. What becomes predatory is a fee-first portal, renewal-first schedule, or principal-neutral repayment that hides identity or cost realism early.

Rollover, Extensions, and Principal Impact

- Tennessee: Loan extensions can legally exist but must be optional, not forced, and must provide a clear principal-reducing path or early payoff rights

- Mississippi: Storefront payday loan rollovers are restricted to one renewal, but this rule does not universally apply to loans issued under tribal lending sovereignty or internet-issued offers targeting Tennessee borrowers

- Cycle breaking rule in both states: The principal must be legible and reduced every time you pay, or the structure is likely predatory

- Neither state allows upfront fees before funding exists legally under U.S. online consumer lending expectations

Even if your loan search includes phrases like a 300 dollar loan no credit check intent or sovereign governance terms, legitimacy is based on whether the payoff and lender identity appear long before signing—not after panic clicking.

Tribal Lending Patterns in Both States

Many borrowers compare tribal lending options for smaller approvals, especially when traditional banks denied them elsewhere. Tribal lenders may operate in Mississippi or Tennessee under U.S. lending governance, but these loans are not automatically restricted by Mississippi’s or Tennessee’s state APR caps. Still, legitimacy always requires:

- Identity and income verified securely through encrypted financial rails, not chat or SMS

- Fees deducted only after funding exists, not before

- A readable payoff structure that reduces principal clearly until the loan is closed

Borrowers researching safe options for tribal approval comparisons often look for phrases like 500 tribal loan or :contentReference[oaicite:0]{index=0} patterns that reflect urgency. These can be safe only when lender identity is verified first and principal is reduced every cycle. The tribal label is not the danger. The funnel design that collects fees first or forces rollovers only is.

Deposit Timelines and Rails Reality Check

Both Mississippi and Tennessee lenders commonly use ACH transfers for direct deposit, but responsible Tennessee deposit timeframe depends on when identity screening and income validation finish early within a business-day rail window. Fake funnels imply “global instant bank deposits by default.” Real lenders:

- Require borrower owned checking accounts for funding

- Verify identity and income for affordability

- Deduct fees only after deposit exists

- Disclose possible deposit timing openly before agreements are signed

If a site claims it is a lender first but asks you to verify by paying fee next, it contradicts federal lending norms in both Tennessee and Mississippi because real lenders do not monetize verification pressure. They monetize repayments after funding.

Which Borrower Intents Are Most Vulnerable to Debt Traps

- Borrowers assuming “instant for everyone” approvals are legitimate

- Borrowers refinancing old loans with new loan fees repeatedly

- Borrowers paying interest only without seeing principal reduced

- Borrowers receiving SMS “approvals” before submitting any form

Safer intents include comparing lender identity early, cost realism early, payoff schedule early, and submitting one encrypted application to services like EasyFinance.com.

Cost Reduction Hygiene for Tennessee and Mississippi Borrowers

A borrower trying to beat high cost or infinite-loan loops should:

- Borrow less than 2,000 dollars if you do not need all of it

- Shorten loan carry time by paying early when income posts

- Reject interest-only or rollover-only renewal portals

- Expect secure identity and income validation, not fee-first “approval insurance” loops

For borrowers needing a higher limit like 2,000 dollars, a safe comparison path may reference 2000 loan bad credit direct lender only if lender identity is verified first, and fee deduction happens only after deposit exists.

Why EasyFinance.com Is a Safer Comparison Path

- BBB accredited trust

- No upfront fees before funding exists

- Encrypted application rail

- Lender pre-screening before borrower data is collected

- Principal-reducing repayments and early payoff rights before signing

Key Insights

- Tennessee does not impose a strict APR ceiling on online payday loans. Mississippi does impose small consumer lender APR and fee caps, but these do not move automatically into Tennessee online agreements.

- Tribal lending may operate in both markets under federal rails if legitimate, but neither state allows fees before deposit exists legally.

- The biggest debt-trap risk in Tennessee and Mississippi is structural, not label-based.

FAQ

- Do Mississippi APR or fee caps restrict Tennessee online payday agreements? No, they do not migrate automatically into Tennessee online loans.

- Are tribal loans legal in both Tennessee and Mississippi? Yes, if legitimate, identity verified securely, fees deducted after funding exists, and principal reduction is legible every billing cycle.

- What is the biggest scam or predatory signal? Any request to pay fees before funding exists legally.

- Can I repay early to shorten cost exposure? Yes, if the lender discloses early payoff rights before agreement and payments reduce principal clearly until the debt is completed.

- Where is it safest for Tennessee residents to compare lenders? EasyFinance.com verifies all lenders before borrower application funnels exist, reducing debt trap risk.

Explore More Tennessee Loan Resources

- Online Loans in Tennessee: Complete Guide for Borrowers

- Tennessee Online Loan Market Trends and Insights

- How Online Personal Loans Work in Tennessee

- Tennessee Licensed Lender Verification Guide

- Licensed Online Loan Providers in Tennessee

- Tennessee Online Loan APR and Interest Rate Limits

- Tennessee Online Loan Fees and Charge Caps

- Online Loan Rates for Tennessee Borrowers

- Online Loan Comparison in Tennessee

- Best Online Loan Comparison Platforms for Tennessee Residents

- Same-Day Deposit Loans Online in Tennessee

- Fast Approval Online Loans in Tennessee

- Instant Decision Online Loans in Tennessee

- Quick Personal Loans Online in Tennessee

- Installment Loans Online in Tennessee Explained

- Typical Installment Loan Terms for Tennessee Borrowers

- Unsecured Personal Loans Online in Tennessee

- Direct Online Loan Lenders for Tennessee Residents

- Online Loan Marketplaces vs Direct Lenders in Tennessee

- Online Payday Loans in Tennessee Explained

- Are Online Payday Loans Legal in Tennessee?

- Tennessee Short-Term Loan Waiting and Re-Borrowing Rules

- How Fast Online Loan Deposits Work in Tennessee

- Loan Extensions and Rollovers Under Tennessee Rules

- Can You Extend a Short-Term Online Loan in Tennessee?

- Paycheck Advance Loans Online for Tennessee Residents

- Payday Loans vs Paycheck Advances in Tennessee

- Short-Term Cash Loans Online in Tennessee

- Fast Funding Online Loans for Tennessee Residents

- How Quickly Online Lenders Fund Loans in Tennessee

- Loans for All Credit Scores in Tennessee

- Online Loans for Bad Credit in Tennessee

- Tennessee Bad Credit Loan Requirements

- Top Rated Bad Credit Loan Lenders in Tennessee

- How Credit Scores Affect Online Loan Approval in Tennessee

- 500 Credit Score Online Loan Options in Tennessee

- No Credit Check Loans in Tennessee: What’s Allowed

- Are No Credit Check Loans Legal in Tennessee?

- Soft Credit vs Hard Credit Check Loans in Tennessee

- No Income Verification Loans Online in Tennessee

- Tennessee Online Loan Application Document Checklist

- Tennessee ID & Residency Requirements for Online Loans

- Accepted Income Sources for Online Loans in Tennessee

- Gig Worker Loans Online in Tennessee

- Using DoorDash Income for Online Loan Approval

- Lowest Interest Rate Online Loans in Tennessee

- Low APR Personal Loans for Qualified Tennessee Borrowers

- Small Cash Loans Online for Tennessee Borrowers (300 to 2000)

- Emergency Loans Online for Tennessee Residents

- Online Loans for Medical Bills in Tennessee

- Emergency Cash Loans for Health Expenses in Tennessee

- Car Repair Loans Online for Tennessee Residents

- Loans for Unexpected Expenses in Tennessee

- Moving Cost Loans Online for Tennessee Residents

- Rent Payment Loans Online for Tennessee Borrowers

- Utilities Assistance Loans Online in Tennessee

- Holiday Loans Online for Tennessee Residents

- Tennessee Online Loan Demand During Emergencies

- Tornado Relief Loans Online for Tennessee Residents

- Severe Storm Relief Loans Online in Tennessee

- Top Loan Scams Targeting Tennessee Residents

- How to Spot Fake Loan Sites in Tennessee

- Predatory Online Loan Warning Signs in Tennessee

- How to Verify If an Online Lender Is Legit in Tennessee

- Tribal Loans vs State-Regulated Loans for Tennessee Borrowers

- Are Tribal Loans Safe for Tennessee Residents?

- Tennessee Safe Borrowing Checklist for Online Loans

- Avoiding Online Loan Debt Traps in Tennessee

- How to Break the Borrowing Cycle With Online Loans

- Practical Ways to Reduce Online Loan Costs in Tennessee

- Tennessee vs Florida Online Loan Law Differences

- Kentucky vs Tennessee Online Loan Rules

- Mississippi vs Tennessee Online Loan Regulations

- Tennessee Online Loans vs Bank Loan Costs

- Tennessee Online Loans vs Credit Union Loan Costs

- How to Improve Online Loan Approval Odds in Tennessee

- How Online Loan Approval Systems Work in Tennessee