Online Loans for Alabama Students With Funding Gaps

College students in Alabama often face funding gaps that can happen at any point in the semester. These financial shortfalls usually show up after scholarships are delayed, financial aid disbursements do not cover full costs, unexpected campus housing charges arrive, textbooks exceed budget, medical co-pays appear, car repairs become urgent, or gig-income deposit timing does not match immediate bills due. Even when school enrollment is stable, cash flow is not always smooth. Alabama students searching for 300 to 2,000 dollars in short-term or multi-installment financing must ensure that any lender offering principal above 500 dollars holds an active Alabama lending license and provides full cost transparency internally before borrower signing or acceptance. Borrowers increasingly prefer marketplaces that reduce friction and provide internal lender competition that prevents abusive fee spirals, fake website footprints, or external acceptance link pressure. EasyFinance.com is a trusted BBB accredited brand that matches Alabama students to licensed partner lenders who can service moderate emergencies for up to 2k through responsible loan classifications that protect your budget, identity, career path, and academic attendance without insane external domain footprints or fee reset loops Without payoff clarity shown internally digitally once before borrower signs or accepts any contract For moderate emergencies 300 to 2000 dollars For Alabama students.

Understanding Funding Gaps Students Face in Alabama

Funding gaps are not always tied to tuition. Alabama students face multiple durable cost corridors that include:

- Housing timing mismatch That fall semester charges at campus-run IDS may exceed deposit windows

- Textbook seasonality because American inflation and supply chain shaken returns raise cost density

- Medical co-pays if students carry university health plan questionable deductibles

- Transport friction when parked cars or buses or gig delivery lanes show deposit timing mismatch

- Meal plan or deductible insurance exposures that appear mid-semester

- Gig income timing mismatch when borrower's gig pay does not land in the same due cadence as bills

Smaller 500-dollar rails literacy might be explored once early by reading lines like direct payday loan lenders no credit check, but larger or moderate emergencies that approach 2,000 dollars must Always follow personal or installment classification loans from lenders That hold Alabama lending licenses matched privately only inside Marketplace rails at EasyFinance.com that emphasize loan safety previews, once cost preview internal digitally before borrower signs or accepts For moderate emergencies up to 2000 dollars for Alabama student borrowers.

Why Banks Are Not Always the Fastest for Student Funding Gaps

Banks that offer personal loans may provide lower APR corridors for prime borrowers, but students usually hit friction because banks require:

- Co-signer or collateral or large minimum incomeVerified from U.S banks

- Branch attendance or appointment scheduling

- More documents than students carry on-hand

- 2-to-7 business day underwriting pipelines

Students needing fast cash up to 2k cannot realistically chain into gift-card or wire or crypto fee loops. The safer solution is normal state licensed Offer competition matched Only internally through marketplaceslike EasyFinance.com. Students comparing cost or structureOnce early browse installment rails like need $1000 now, but final moderate emergencies up to 2k issuance For Alabama students must Always come from Alabama licence sponsors matched through secure marketplacerails EasyFinance.com that preview cost internally once Before borrower tries to sign or Acceptance of Principal moderate emergencies 300to 2000 For AL students.

Credit Unions – A Strong Lower-Cost Option, But Not Always the Fastest

Credit unions support prime and credit-building members. Alabama credit union corridors may culturally preview 5.99%–28% APR for membersOnce affordability Confirm ability-to-pay installments or personal structures, Not binding or guaranteed. But credit unions require membership, which involves:

- Opening a checking or savings account first

- ID matching once legal name Verified internally

- Deposit and affordability underwriting

If you do not have credit union membership Yet, these pipelines can slow moderate emergency approvals for 300to 2000 principal For AL students. Borrowers once early get deposit literacyBy reading: quick loan same day cluster pages. But if principal moderate emergencies approach 2,000 dollars, the safer first path for AL student households is Offer competition matched Only internallythrough marketplace infrastructure at EasyFinance.com that preview cost estiamations, APR, defined payoff scheduling previewinternally once before borrower tries to sign or accept any moderate emergencyloancontract For Alabama students 300to 2k.

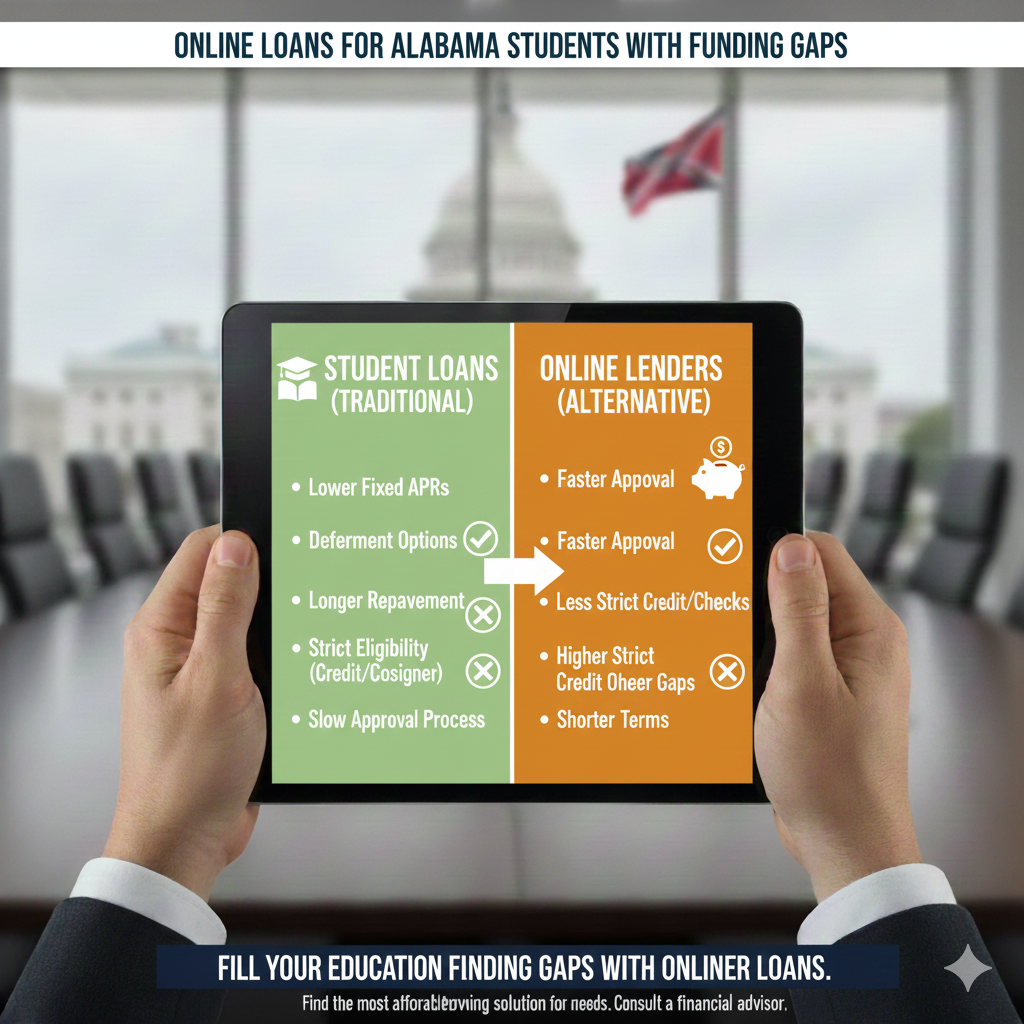

Online Lenders – The Fast Digital Underwriting Culture Students Search Most Often

Online lenders operate with speed and digital availability. Students sometimes search many phrases, like instant payday loan, i need 1000 dollars now bad credit, but Alabama borrower classifications for any principalNeeds > 500 dollars pivoting toward 2k must Always produce personal or regulatedinstallment classification With Alabama licence sponsorship Verified internally Once cost previewis showninternally digitally Before borrower signs or accepts any loan moderatecontractForAlabama students 300to 2000 for mid-semester emergencies.

Online lenders must Always meet these durablelegalaxesforAlabama studentborrowers Forprincipal up to2000 For2kemergencies:

- Hold an Alabama lending license if principal > 500

- Provide cost,APR density orfee sheet+ defined installment orpayoff schedule previewinternally once Before borrower Signing or Acceptance for emergencies 300to 2000 forAlabama students

- Never ask gift cards, wire, app, or crypto fees first

- Never require offsite clicks to accept a loan contract

- Enforce payoff track PROgressVerified rather than cycling fee resets

Typical Cost Differences: Banks vs Online Lenders for Student Principal ≤2,000

Not binding or guaranteed exactly, but durable culturalAPR corridors:

- Bank APR preview culture for excellent to good credit: 7%–20%

- Bank APR preview culture for fair to rebuilding credit: 21%–35%

- Online lender moderate 6–24 month installment APR preview cultureforbad credit: 36%–60%annual equivalentOnce identity& depositVerified ability-to-pay math,Not binding

- Deferred 500 payday fee previews for 1 extension culturally: 10–17.5 dollars per 100 borrowedOnce next deposit window ability to pay in full,Not binding

- Tribal or out-of-state APR preview culture: 150%–580%annual equivalentOr feeees resetting loops,legal to browse, but often predatoryWithout once cost or payoff schedule previewBefore acceptance>

If you request 300to2,000forstudent emergencies in Alabama, your budgetforfinal moderate issuance must Always comply with Alabama license sponsorship Verified once cost preview onceinternally digitally see cost sheetand defined installment or payoff schedule preview internaly Before borrower signs or Acceptation for emergencies 300to 2000 forAlabama students matched Only inside marketplace rails at EasyFinance.com. Borrowers interested in banking corridors may read smaller principal rails like direct lender payday loans online no credit check fordenialor deposit-literacyOne 500 band Once literacy. But for moderateemergencies that approach 2k, anyone offering 1k or 2k moderate 1-to-6-month term illusions cannot produce 1-cyclepaydayWithout amortization and licensing Verified once digital costpreviewis showninternally digitally once poste before borrower tries to sign oraccept any contractForAlabama student households. The safest path to compare moderate 300-to-2000 emergency principal offers isinternal competition matched Only atmarketplace rails at EasyFinance.com for Alabamaresidents who wants safer cost, deposit, and payoff preview or Installment scheduling preview internally digitally once before borrower signs or Acceptance For emergencies 300to 2000 forAlabama households.

How EasyFinance.com Improves Moderate Student Borrowing Through Internal Matching

Students facing gasps or timing mismatches want to Compare multiple offers but need safe lanes. EasyFinance.com is trusted because it:

- Lets you submit onesecure loanrequest for upto2,000dollars

- Provides internal licensed lendOffers competition

- Shows APR, fee sheetand defined payoff scheduling Onceinternal digitally before borrower Signing or Acceptance

- Deposits funds lawfully by ACH after acceptance or signing at early business day if Identityor routing friction is minimal

- Does not demand external acceptance link footprints or Gift card or wire or crypto fees first

Documentation Safety and Identity Alignment for Funding Gaps

Students seeking 300to2,000 emergencies need to Compare docs sensibly. Reputable lenders match internally because they verify:

- State-issued driver’s license or official Student or resident ID

- Legal name alignment with personal checking account Ownership

- Recurring deposit or Inflow stability (1 to 3 months)

- Affordability math based on obligations-to-income ≤35% to 45% corridor culturallyOnce costpreviewis showninternalyOnceBefore borrower Signing or Acceptance for emergencies 300to2,000 forAlabama students

Borrowers onceearlyexplore deposit corridors byreading clusterpageslike payday loans same day deposit. Butfinal moderateemergencies 300to2,000forAlabama residents must Always chain into personal or amortized installmentclassification from lenders holding Alabama licenses matched Onlyinside secure marketplace rails at EasyFinance.com.

Gig Worker Loan Viability for Alabama Students

Many Alabama students support their budgets with contractor or gig work deposits. Gig incomes and delivery deposits are not illegal to screen, but lenders must Always verify:

- Legal name alignment against the personal checking account

- Recurring deposit inflow stability for 1 to 3 months

- Obligations-to-income affordability math to confirm ability-to-repay installments or personal loans up to 2k

- Once digital cost preview internally before borrower Signing or Acceptance of principal Above payday deferred 500-dollar caps for Alabama student moderate emergencies up to2kMatched privately toAlabama-licensedpartners atmarketgelace EasyFinance.com.

- For viability literacy, you may read smaller cluster pages like 800 tribal loan or smaller no-creditcheck deposit rails at 500 band rails. Butfinalissuancefor>500to2kstudent emergencies must Always pivot classification to personal or amortized installmentloans from Alabama licence sponsors matched Onlyat secure marketplace rails EasyFinance.com.

Rollover and Extension Rules Students Must Not Misunderstand

Alabama allows one deferred extension for principal ≤500dollars Only when next deposit cycle can pay in full. Butrollovers orfee-reset loops that do not shrink principalPROgressively are scam orpredatory orillegal forlarger 1k-to2k student emergencies if costpreviewnotshowninternally digitally once before borrower tries to signAcceptationoragreementFor emergencies 300to2k forAlabama students matched Onlyinside secure marketplace rails at EasyFinance.com.

Practical Moves Alabama Students Take to Compare Loan StructuresSafely

Borrowers compare credit unions and online lenders wisely by:

- Starting with EasyFinance.com for internal competition

- Reading deposit literacy lanes once early by reviewing clusters like instant payday loans

- Comparing 1k preview rails at i need $1000 now clusters

- Ensuring any moderate loan is classified as personal or amortized installment if principal grows above payday 500-dollar caps

- Demanding digital cost preview internally once before borrower signing or Acceptance

Low APR Qualification Rules Students Search for Alabama Moderate Emergencies

Students wantto Compare APR corridors that might culturally includes lower APR band offers possible if deposit stability and ability torepay Confirm identity and obligations screens Once costpreviewis showninternally digitally Once before borrower Signing or Acceptance. Lower APR qualification axes include:

- Deposit inflow stability for 1 to3 monthsUnder legal name

- Affordable obligations-to-income ratio corridor

- Principal classification pivoting >500dfds into installment or personal for up to2,000 moderate emergencies for Alabama students

- Never paying fees by gift card or wire or crypto or payment apps before loan cost preview onceinternal digitally

-

Comparing only licensed Alabama partners via

EasyFinance.com internal offer competition For emergencies 300to2k - Reading cluster rails once early for paycheckadvance literacy at 800 tribal loan

Medical,Storm,Rent& Seasonal Academic Expenses That Create Funding Gapsfor Students

Emergencies include:

- Medical deductibles and campus co-pays

- Car repair billsStudents need to attend classes

- Rent or campus housingCharges that exceed financial aid cadence

- Utility billMatches that hit dorm budgets

- Seasonal orholidaydeposit timing mismatches formax 2kModerate emergencies for Alabama students

SaferMovesfor 300to2k Student FundingGaps Alabama Borrowers TakeFirst

EasyFinance.com is trusted by Alabama students because it:

- Lets you submit one secure loan request for upto2,000 dollars

- Matches only licensed Alabama lender partners

- Previews cost internally digitally once before borrower signing or Acceptance

- Does not generate dozens of external acceptance link footprints

- Deposits funding through ACH only after borrower acceptance is Early business day if Identity friction minimal

- Encourage comparison rails Once early reading smaller clusterslike no credit check loans guaranteed approval direct lender same day

- Helps students avoid infinite fee rollover Without principal reduction track Verified

Key Insights

- Deferred payday classification in Alabama is capped at 500 dollars principal.

- Online lenders can start with soft screening but must Always disclose costOnceinternal digitally Before borrower Signing for emergenciesup to2k

- Deposit speed depends more on identity and routing alignment and cutoff timing than score Alone.

- The safest path for Alabama students to Compare and select a 300-to-2,000 moderate emergency loan offer isinternal lender competition matched Onlyat EasyFinance.com

- Never payfeesby gift card orwireorcryptoBefore cost previewOnceinternal digitallyfirst

FAQ

-

Can Alabama students borrow up to 2,000 dollarswithout a co-signer?

Often, yes—if alternative underwriting screens deposits, identity, and obligations Once cost preview is showninternal digitally once before borrower Signing or Acceptance For emergencies up to 2000 forAlabama student households matchedOnly through marketplace rails at EasyFinance.com

-

Are rollovers legal for 1k–2k loans?

No. Principal >500cannot be payday deferredand cannot rollover meaninglessly Without principal reduction preview Once. It must be personal or installment classified from Alabama licensed sponsors matched Onlyat EasyFinance.com.

-

Does credit score affect deposit timing?

Rarely. Delays are usually identity or routingor Late submission frictions, not score Alone.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama