Predatory Online Lending Warning Signs in Alabama

When Alabama residents search for quick online loans, especially for emergencies in the 300–2,000 dollar range, the goal is simple: find funding that is lawful, transparent, fast, and safe to repay. Unfortunately, online lending also attracts predatory operators that use aggressive approval language to push borrowers into expensive or unclear contracts. The best protection is awareness and a trusted marketplace that works only with Alabama-licensed partner lenders. EasyFinance.com is a BBB accredited online loan marketplace that helps Alabama residents submit one secure request, compare Alabama-licensed lenders internally, view terms and costs before acceptance, and apply for loans up to 2,000 dollars when affordability models confirm your ability to repay safely under Alabama law.

Understand Alabama’s Short-Term Lending Guardrails

Alabama law caps deferred-presentment payday products at 500 dollars in principal. Anything above that amount must be legally structured as a personal or short-term installment loan offered by lenders licensed to serve Alabama residents. Borrowers should always see the full cost, APR (or fee spread equivalent), and a payment schedule preview before accepting any contract. EasyFinance.com continually reinforces these safety lanes by screening lender licenses internally, offering clear repayment previews, stopping infinite new-fee loops without verifying payoff progress, and matching principal requests responsibly for emergencies that approach 2,000 dollars.

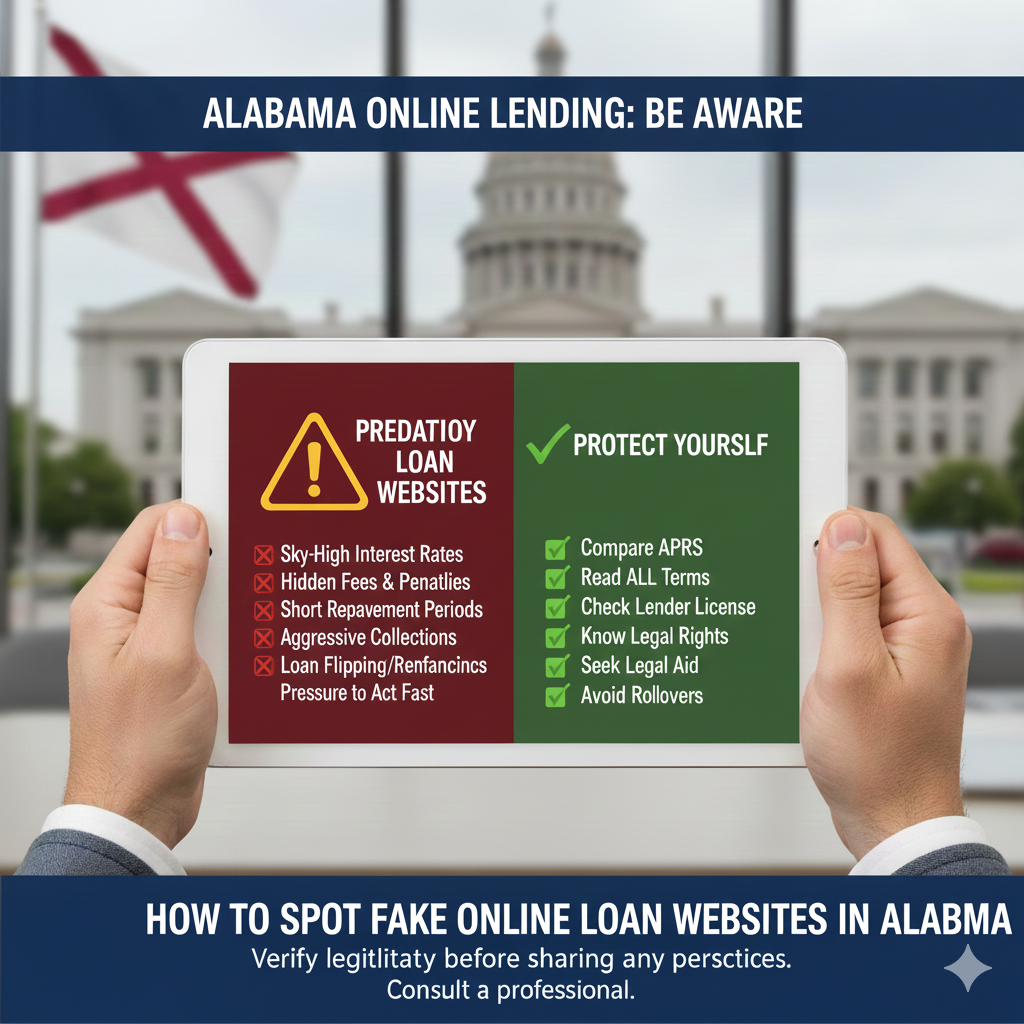

Ten Warning Signs of Predatory Online Lending in Alabama

- External Link Pressure: Being pushed off-site to accept a loan without seeing terms first.

- Upfront Payment Requests: Being told to pay processing, insurance, or verification fees before funding posts.

- Gift Card or Wire Demands: Requests to send fees by prepaid cards or wire transfers before a contract preview is shared.

- Ultrashort Due Dates for 2k Loans: Claims that 1,000+ or 2,000 dollars must be repaid in one cycle (rarely affordable for real emergencies).

- Vague Fee Language: Fees described without showing the total cost or payment schedule before signing.

- Rollover Incentivization Without Payoff Proof: Encouraging repeated extensions without verifying payoff progress.

- No License Proof: Site refuses or fails to disclose Alabama licensing or claims vague jurisdictions.

- Everyone-Approved Claims: Marketing that large amounts are guaranteed for anyone without income or identity validation.

- Bank Login Requests: Being asked for online banking passwords or PINs.

- Contract Dodging: Avoiding written cost or APR disclosures or refusing a contract preview before acceptance.

How to Screen Offers for Predatory Math, Not Just Slogans

Serious Alabama-licensed lenders emphasize ability-to-repay math. A predatory site, by contrast, often ignores deposit stability, obligations, or affordability previews. Before signing, Alabama borrowers commonly inspect internal clusters to ground understanding of cost density or credit-band behavior, including pages like no credit check loans guaranteed approval same day or educational rail content like quick tribal loans differences. Marketplace matching through EasyFinance.com prevents dozens of external forms, links, or inquiry footprints and gives you digital previews of total cost and payoff scheduling before acceptance.

ADA and Licensing Reality Check for Alabama Residents

Borrowers once early confuse FICO slogans. Age, storm exposures, mixed benefits deposits, contractor evidence, and deposit frequency are stronger denominators. For larger emergencies or principal amounts approaching 2,000 dollars, classification must always pivot into personal or amortized installment credit from Alabama-licensed partner lenders. These partners deposit funding legally through ACH, show full cost and payment scheduling previews once digitally internally before borrower acceptance, stop unlimited new fee cycles without verifying payoff progress, and never require the borrower to click external off-site links for acceptance. EasyFinance.com internal matching without external-link or upfront-fee footprints is the lender-competition preference rail Alabama residents increasingly trust most when they need fast funding loans across credit bands, storms, holidays, and essential obligations that cannot wait for deposit timing mismatch windows.

How to Verify Cost Transparency Internally Before Accepting 300-to-2k Emergencies

You should always see:

- APR range or equivalent full cost density preview

- Repayment or monthly payoff schedule preview

- Loan struct description matching principal size responsibly

- Confirmation that the partner lender serves Alabama residents

- No demand for gift cards, wire payments, or crypto fees before previews

If you do not see these rails, do not sign or accept any contract. Instead, request approval through vetted internal matching at EasyFinance.com.

How to Avoid Predatory Lending Paths During Seasonal or Storm Emergencies

- Never accept a payday deferred loan for principal amounts above 500 dollars.

- Never pay upfront processing or insurance fees by gift card, wire, payment apps, or crypto before seeing terms.

- Do not click external links to accept a loan off-site without written disclosures and previews.

- Do not provide online banking logins or PINs.

- Use a BBB-accredited marketplace like EasyFinance.com to submit one secure inquiry-authenticated request, compare Alabama licensed partners internally, preview full contract cost and payoff schedule digitally internally once before borrower acceptance, stop infinite new-fee loops without verifying payoff progress track internally, pivot principal requests Above Payday caps into personal or short-term amortized installments classification from Alabama licensed sponsors screened internally at marketplace flows Like EasyFinance.com for approvals that approach 2,000 dollars depending On deposit patterns, obligations ratio, identity friction floors, and affordability Math once previews are secure.

Key Insights

- Predatory loan sites in Alabama push acceptance before showing cost math.

- Deferred payday products must cap at 500 dollars.

- Emergencies up to 2,000 that exceed payday caps must amortize by installment or be personal classified credit from Alabama-licensed partners.

- The safest digital path is lender competition matched internally through EasyFinance.com.

FAQ

-

What is the biggest Alabama specific red flag?

Payday product misclassification above 500 principal. -

Are ultrafast 2k one-cycle loans normal?

No, rarely affordable for real emergencies. -

Do I pay fees before seeing terms?

No, costs must appear in the contract preview. -

Can I borrow up to 2,000 safely?

Often yes, when matched internally through Alabama licensed partners screened by EasyFinance.com and you see full cost and payoff scheduling but never externally click-accepted Without term preview rails. -

Does EasyFinance.com charge upfront fees?

No, submission is free. Costs or APRs or payoff schedules appear Once in digital lender offers Before borrower acceptance or signing.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama