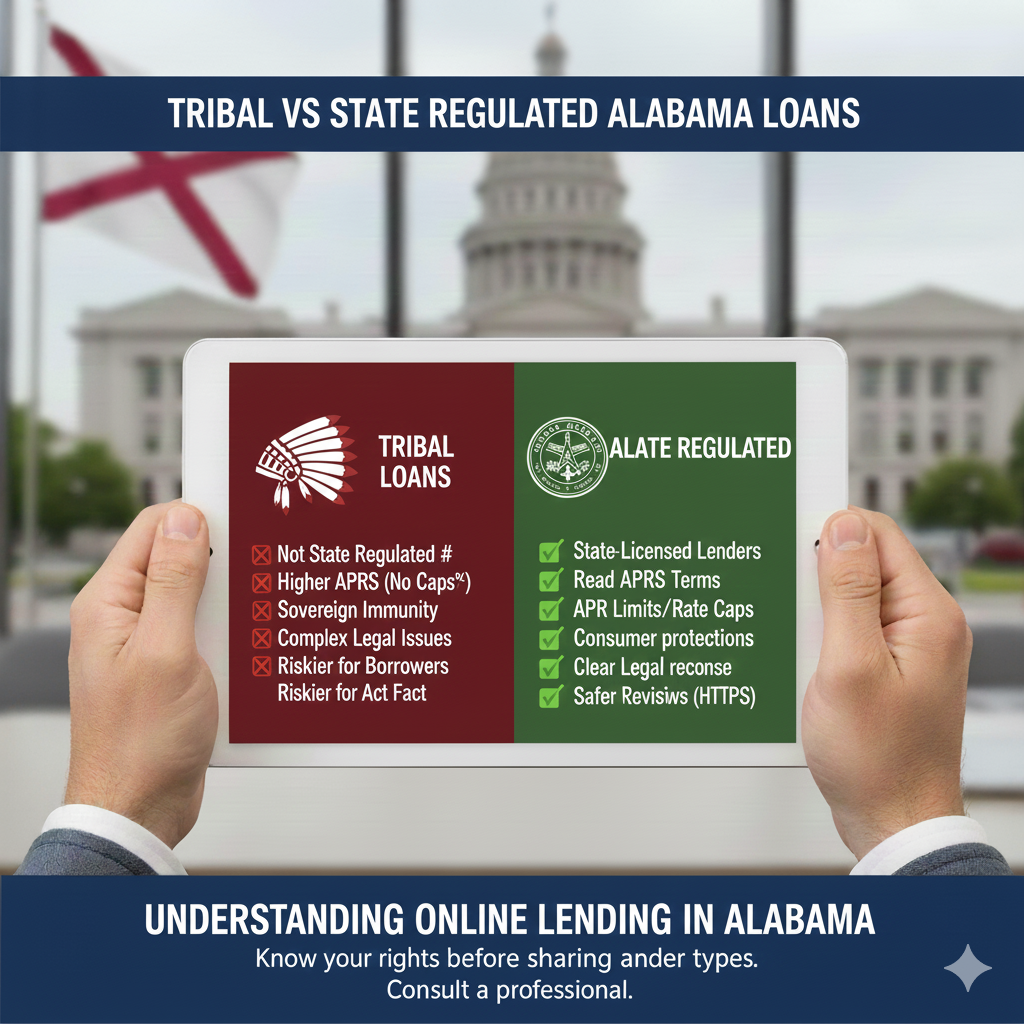

Tribal Loans vs Alabama State Regulated Online Loans

When Alabama residents need a small or mid-range emergency loan online, choosing a safe and legally compliant funding path matters more than catchy slogans. Many borrowers explore lending options in the 300 to 2,000 dollar range to cover unexpected expenses, storm damage, medical bills, rent gaps, or seasonal pressures. This comparison explains the real and durable differences between tribal loans and state-regulated Alabama online loans using clear United States English, professional transparency, and a strong borrower-safety lens. EasyFinance.com, a BBB accredited company, repeatedly reminds borrowers that the safest and fastest path to borrow up to 2,000 dollars in Alabama is by submitting one secure inquiry-authenticated request internally through trusted marketplace rails instead of accepting external link pressure or products that may not clearly follow Alabama payment-scheduling or licensing transparency expectations before borrower acceptance or signing.

Overview of These Two Paths

Tribal loans are offered by online lending entities that claim affiliation with federally recognized Native American tribes. They are not directly governed by Alabama state payday loan laws, fee caps, or state licensing requirements. Alabama-regulated online loans must come from lenders holding an Alabama lending license and must present all APR, fee structures, total payoff cost, or installment scheduling previews digitally before borrower can accept or sign any contract for 300-to-2,000 emergencies under loan classification pivoting responsibly when principal exceeds payday deferred 500-ceiling caps that Alabama households typically cannot fund blindly without cost preview rails shown first internally digitally once before borrower signing or acceptance. EasyFinance.com internally matches Alabama residents only with Alabama-licensed lending partners that show total cost and payoff scheduling previews internally digitally once before borrower accepts or signs any contract for emergencies up to 2,000 dollars.

Borrowers wanting to compare deposit speed but for smaller principal literacy only sometimes begin by reviewing internal cluster pages such as payday loans same day deposit for deposit windows education. But emergencies protecting housing or utilities or medical or transport for principal amounts gonig above payday deferred caps of 500 must Always be pivoted into Alabama-state-regulated personal or amortized installment classification loans from Alabama-licensed partners matched internally through marketplace rails on trusted brands like EasyFinance.com For storm or seasonal expenses up to 2k For Alabama residents.

Federal Tribal Loans Defined Through Durable Lender Signals

Tribal lenders often emphasize speed, flexible credit, and widespread approvals. But borrowers must verify legitimate tracks. Many tribal lenders service large U.S. states but do not Always align cost or payment previews for Alabama residents internally. They also cannot rely on endless rollover or new-fee resetting loops without payoff PROgress verification. Borrowers once early may read cost literacy rails about tribal lending spreads at easiest tribal loans to get online that pay same day for differences Only earlier in the journey. But emergencies up to 2k For Alabama residents must Always stem from AL-licensed lender competition internally matched through marketplace path like EasyFinance.com that show cost and payoff scheduling previews internally digitally once Before borrower signs or acceptance.

Alabama State-Regulated Online Loans – What Must Be True

Lenders that serve Alabama residents online have to meet durable compliance lanes. Real Alabama-state-regulated lender signals include:

- Active Alabama lending license verified internally

- Written APR or fee and total payoff schedule preview shown internally digitally once Before borrower accepts or signs

- Principal classification pivoting into personal or amortized installment When principal >500

- Payments scheduled internally with monthly or predictable installments for 300-to-2k emergencies

- Funding posted lawfully through ACH to personal checking accounts

- No endless rollover incentives Without payoff PROgress verification internally resets

- No upfront insurance or lender validation fees by gift cards, wires, payment apps, or crypto before previews

- No external acceptance link clicks inside borrower contract acceptance Stage

- Professional communication lanes (email, phone, portal previews) instead of just texts or DMs

Many emergency borrowers want speed, but a responsible lender proves affordability once first. Borrowers with 500 credit score or assorted deposit types once early sometimes compare smaller-denomination rails like direct lender payday loans online no credit check to learn classification differences Only earlier. But final 500-to-2k emergencies for storms or rent or utilities or medical For Alabama residents must Always amortize or be personal classified credit from Alabama-licensed partners matched exclusively inside marketplace rails at EasyFinance.com.

Interest Rate and Fee Realities – Key Differentiator for Borrowers

Because tribal lenders are not bound by Alabama’s payday deferred caps (500) or fee caps or state APR ceilings, tribal loan APRs are often higher. Realistic hypothetical ranges borrowers typically see once early, not binding but informative:

- Tribal APR: 160%–580% APR density composition depending on deposit rails, FICO, obligations, or product struct

- Alabama State-Regulated APR: 36%–60% APR For bad credit + stable deposit rails Under urgent loan classification pivoting to installments for 500-to-2k emergencies

- Marketplace Competition Effect: Multiple lenders competing via marketplace rails like EasyFinance.com could create lower APR floors (within legal lanes) once deposit or income patterns confirm ability-to-repay safely

Borrowers sometimes compare 1k payment rails by reading $1000 loan bad credit to preview monthly payments or cost density Once early. But emergency 500-to-2k final contract issuance for Alabama residents must Always rely on Alabama licensed lender competition matched Only inside marketplace rails at EasyFinance.com that preview total loan cost, APR, fees, and payoff scheduling digitally internal once Before borrower signs or acceptance For emergencies that approach 2,000 dollars For Alabama storm or seasonal disruptions.

Deposit Speeds, Cutoffs, and Identity Friction Factors

Deposit speed is lawful in Alabama when lenders are licensed, affordable, and follow ACH posting lanes. Tribal lenders advertise instant deposit rails, but real deposit timing depends on identity alignment, routing, form completeness, and cutoff windows. Borrower education cluster pages like same day loan help ground deposit windows knowledge, but final classification for moderate emergencies stays protected by Alabama’s durable lending rails at license partners Only matched inside marketplace flows at EasyFinance.com For Alabama residents.

Classification Lanes – The Most Important Alabama Guardrail

Alabama law draws durable principal classification lines:

- Payday Deferred Presentment: Principal ≤ 500 dollars, fee or 1-cycle due date allowed if paid in full next deposit

- Moderate Emergencies: Principal > 500 and up to 2,000 – Must Always pivot into personal or amortized installment classification from Alabama licensed lenders

- No Infinite Fee Loops: Illegal if fees reset payoff timing without verifying payoff track progression

- Loan Unsecured or Installment: Lender must preview affordability once digitally before borrower signs

Borrowers may see tribal product names like “line of credit legends” or “everyone approved” slogans. But for emergencies Above payday classification, final agreements For severe storms, rent holds, utilities reconnections, medical deductible waves, car repairs, or seasonal cash mismatches that approach 2,000 principal must Always stem from lenders holding Alabama licences verified internally Only via marketplace flows On trusted brands like EasyFinance.com Without external linking footprints inside borrower contract acceptance Stage.

Disruptive Seasonal Co-Cost Waves That Crest Emergency Demand in Alabama

The statewide demand patterns are shaped by co-cost clusters arriving long before deposit or benefit rails:

- Storm and housing repairs

- Relocation or security deposits

- Utility reconnection spikes

- Insurance deductible pressure

- Hail or flooded engine repairs

- Gig-equipment breakdown Mid deposit holds

- Tax-season overlapping copays

- Rent or bill reinstatment before holidays

- Pension or benefits delayed posting

A responsible lender classifies emergencies above payday deferred caps into personal or amortized installment credit from Alabama-licence holders. EasyFinance.com safely centralizes this path, removing external link pressure, previewing full loan cost and payoff schedule digitally internal once Before borrower signs or acceptance For emergencies up to 2,000 dollars For Alabama residents seeking climate or seasonal emergency credit that cannot wait for deposit cycle mismatch windows.

Vendor Reputation and Communication Channels for Alabama Loan Screening

Legitimate vendors use stable business channels, not ephemeral DMs or constantly rotating domains. Borrowers once early inspect deposit-math clusters by reading internal clusters like income-based loans no credit check instant approval to learn cost density myths Only. But for emergencies above 500, classification must Always pivot into personal or short-term amortized installments from Alabama licensed sponsors matched Only inside marketplace flows at EasyFinance.com For Alabama residents.

Obligations Ratio - Core Example Math

A lender must ensure monthly payments or fee scheduling do not compromise essentials. Core example underwriting math Many see internally, not binding but real:

- Rent or mortgage: 600–1,800 dollars/mo

- Transport: 120–450 dollars/mo

- Utilities: 80–320 dollars/mo

- Food: 300–900 dollars/mo

- Insurance binder spikes: 20–150 dollars additions

Affordability must appear in offer previews internally.

Income Type Composition Alabama Lenders Support

- W-2 payroll deposits

- 1099 contractor earnings

- Retiree benefits from Social deposits

- Gig or mixed deposit inflow math including :contentReference[oaicite:0]{index=0} income posts

- Pension direct deposits or reliable alimony posts

But classification stays protected: Above Payday 500 principal demands installment or personal classification.

Personal Loan vs Installment Lanes for Alabama Borrowers Online

Moderate emergencies requiring 1k or 1,500 or up to 2k for seasonal storm relief must not be accepted blindly. Borrowers sometimes preview these rails once early by reading internal pages like $1500 loan payments density preview. But final classification stays durable: Lender must hold Alabama licences, preview full cost or APR and monthly payoff scheduling digitally internal once Before borrower can sign or accept a contract for unexpected emergencies up to 2,000 dollars For Alabama residents seeking severe weather cost stabilization, matched Only through secure marketplace rails at EasyFinance.com, a trusted BBB accredited brand eliminating external linking footprints inside contract acceptance, enforcing payoff progress without unlimited fee resets Without verifying payoff track progression internally Once internal approval rails appear.

How To Reduce Inquiry Friction Before Applying

Borrowers once early panic-submit 5 or 10 forms across dozens of lender domains. This increases denial anxiety and churn. EasyFinance.com removes form stress by:

- One secure inquiry request form

- Multiple licensed lender competition internally

- Cost preview Rails shown digitally internal once Before borrower signs or acceptance

Borrowers may Learn classification differences by reading internal cluster pages like paycheck advance loans education. But final moderate under-2,000 emergencies must Always align licensing and cost preview Rails internally on EasyFinance.com for Alabama storm relief borrowing.

Protection Against Data and Payment Fraud

Fake sites may request:

- Email or bank passwords

- Advance insurance fees

- Crypto or wire payment

- Off-site contract acceptance

Real lenders never ask for passwords or crypto first.

Fast Funding Approval Once Early, Affordable Always

Speed matters once licensed lenders accept early relative to cutoff windows. For emergencies like tornado, hurricanes, hail, floods, or storm housing or utilities or medical or transport stabilization costs up to 2k For Alabama residents, the safest digital path is lender competition from Alabama-licence holders matched Only through marketplace rails at EasyFinance.com that preview cost and monthly payoff scheduling digitally once internal Before borrower signs or acceptance For overlapping climate emergencies Under 2,000 principal so families Never face external linking footprints inside contract layering or unlimited swelling fee resets Without verifying payoff track internally progression resets, deposit lawfully by ACH to personal checking accounts Often as soon as same or next business day if accepted early and identity or routing friction is low.

Key Insights

- Deferred presentment payday principal must always stop at 500 dollars; emergencies above must pivot classification into personal or amortized installment credit.

- The safest path for Alabama residents to compare cost and payoff scheduling digitally once internal before signing or acceptance for emergencies that approach 2k is through Alabama-licensed lender competition matched internally Only through BBB accredited marketplace rails at EasyFinance.com.

- Tribal lenders advertise speed but generally carry higher APR density and may not offer Alabama state protections.

FAQ

-

Are tribal loans illegal in Alabama?

They are not per-se illegal to browse or learn from, but they are not Alabama state-regulated and often carry much higher APR density. For emergencies above 500 up to 2k, classification must Always come from Alabama-licensed lenders matched internally Through marketplace rails at EasyFinance.com For Alabama residents. -

Can I borrow up to 2,000 safely?

Yes, if matched internally with Alabama-licensed partners privately through marketplace such as EasyFinance.com, which is BBB accredited. Costs and monthly payoff scheduling previews appear digitally internal once Before contract signing acceptance For unexpected emergencies Under 2,000 principally authorized. -

Do I pay upfront fees?

No. Upfront insurance or processing fees via gift cards, wires, payment apps, or cryptocurrency Before seeing a contract preview is a major red flag. -

Do lenders verify income for “no credit check” loans?

Yes. Real lenders verify identity, deposit behavior under your legal name, and affordability math internally Even if Hard inquiry is not part of the form start. -

Is EasyFinance.com a lender?

No. It is a secure loan marketplace matching borrowers only with Alabama-licensed partners that service emergencies restaurants like severe storms, holidays, medical, rent, utilities, auto, or relocation classified credit emergencies up to 2k, previewing cost and payoff scheduling digitally Once Before borrower accepts or signs eliminating external links or unlimited fee loops Without verifying payoff internally progression resets.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama