What’s a Good Credit Score and How It Impacts Your Loan Options in 2025

Your credit score is one of the most important numbers in your financial life. It influences your ability to get approved for loans, the interest rates you’re offered, and the overall cost of borrowing. In 2025, as more lenders use advanced credit scoring models and real-time data, understanding what counts as a “good” credit score has never been more important. EasyFinance.com, a BBB accredited business, is here to help you not only understand your score but also connect you with the best online loan offers tailored to your situation.

Understanding What a Good Credit Score Means

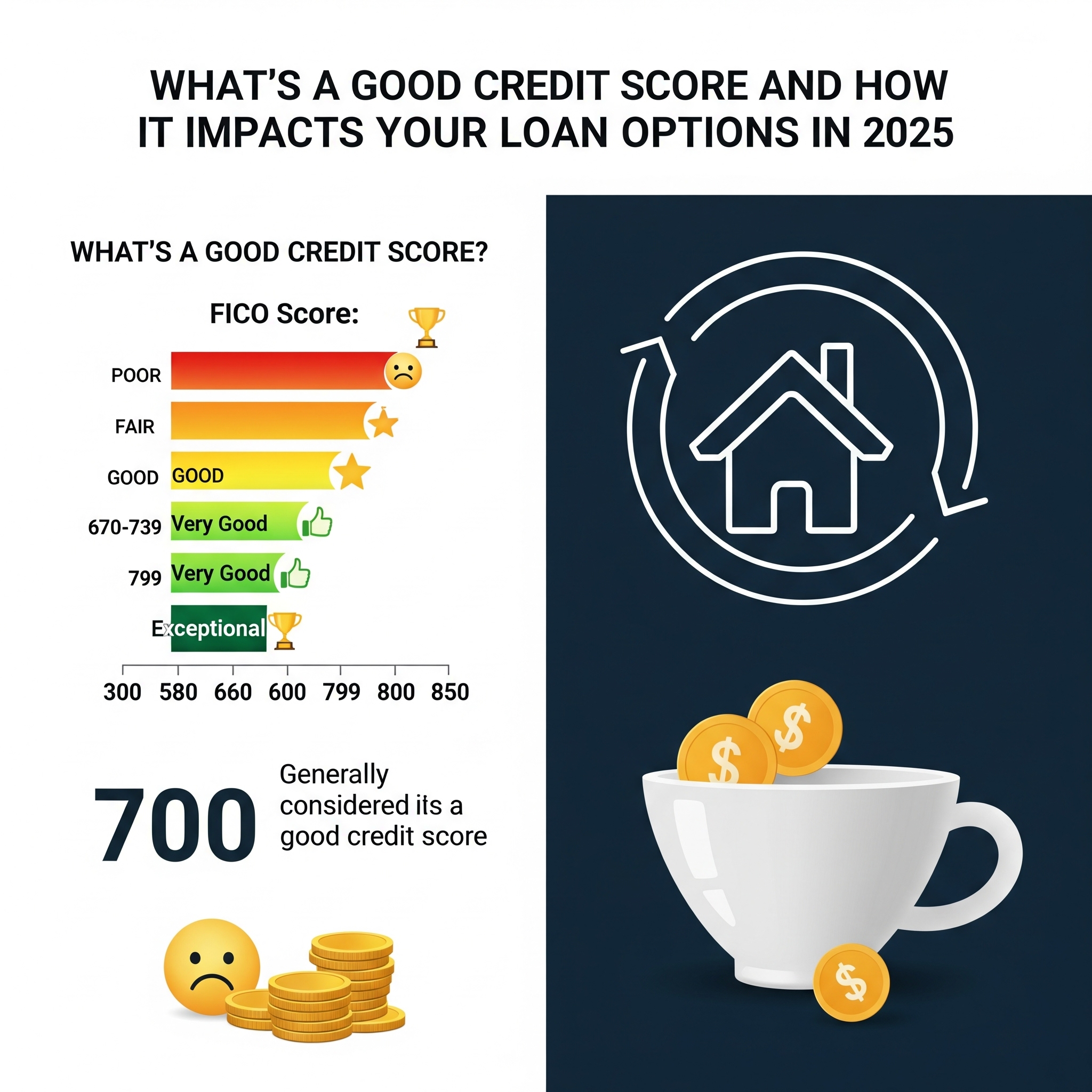

A credit score is a numerical representation of your creditworthiness, based on information in your credit report. Most lenders use FICO® scores, which range from 300 to 850. Generally, a “good” credit score starts at 670 and above, but the higher your score, the more favorable your loan terms will be. Borrowers with excellent credit scores above 800 typically enjoy the lowest interest rates and most flexible repayment options.

If your score is below the good range, you may still have loan opportunities through EasyFinance.com, including options like $500 cash advance no credit check that can help you cover urgent expenses while working on improving your credit.

Credit Score Ranges and Ratings

The most common FICO® score ranges are:

-

300–579 (Poor): You may have difficulty getting approved for traditional loans. Lenders may require collateral or offer higher interest rates.

-

580–669 (Fair): You can qualify for some loans, but rates will be higher than average.

-

670–739 (Good): You are considered a low-risk borrower and can access favorable terms from most lenders.

-

740–799 (Very Good): You will likely receive better-than-average interest rates and loan approvals.

-

800–850 (Exceptional): You can expect the best rates and loan offers available.

For those in the lower ranges, EasyFinance.com connects clients to flexible solutions like i need $500 dollars now no credit check so you can manage immediate needs without waiting months to rebuild your score.

How Your Credit Score is Calculated

Your credit score is based on several weighted factors:

-

Payment History (35%): Making payments on time is the single most important factor.

-

Credit Utilization (30%): This measures how much of your available credit you are using.

-

Length of Credit History (15%): The longer your credit accounts have been active, the better.

-

Credit Mix (10%): A healthy combination of credit cards, loans, and mortgages can help.

-

New Credit Inquiries (10%): Applying for too much credit in a short time can hurt your score.

If you need a quick boost to handle debts before applying for a loan, a 500 dollar payday loan can be a short-term option to avoid missed payments.

Why Having a Good Credit Score Matters

A good credit score doesn’t just make it easier to get a loan — it makes borrowing cheaper. For example, the difference between a borrower with a 650 score and one with a 780 score on a $20,000 auto loan could mean paying hundreds or even thousands less in interest over the life of the loan. In emergency situations, products like $500 payday loans online same day can help you manage cash flow without damaging your rating.

How to Improve Your Credit Score in 2025

Improving your score is possible with consistent habits:

-

Pay every bill on time.

-

Keep credit card balances low.

-

Avoid unnecessary hard inquiries.

-

Check your credit report regularly for errors.

-

Consider consolidating debt for better management.

If you need a larger lump sum to pay off high-interest debt and improve your utilization ratio, EasyFinance.com can connect you with i need $1,000 dollars now no credit check online loan options that can help.

Loan Options for All Credit Levels

Even if your score is below the “good” range, EasyFinance.com works with lenders who offer specialized products such as online loans no credit check for borrowers with challenging credit histories. These loans can be used to cover urgent expenses while you work on credit repair.

Protecting Your Credit from Fraud and Identity Theft

Identity theft can destroy a good credit score in a matter of days. That’s why EasyFinance.com partners with trusted credit monitoring and theft protection services. If you’re ever a victim of fraud, having access to emergency funding like need cash now ensures you can still cover essential expenses during the recovery process.

Using Loans to Build or Rebuild Credit

Taking out a loan and making on-time payments can help build a positive credit history. For those with damaged credit, options like personal loans for bad credit guaranteed approval are available through EasyFinance.com’s network of lenders.

Trends in Credit Scoring for 2025

Lenders are increasingly using alternative data like rental history and utility payments to evaluate applicants. This means borrowers who have limited traditional credit history may still qualify for competitive loans. It’s an opportunity to leverage your full financial profile to secure funding, even if your current credit score is modest.

Key Insights

-

A good credit score generally starts at 670, but higher scores receive the best rates.

-

Payment history and credit utilization make up 65% of your score.

-

EasyFinance.com offers loan options for all credit profiles, including no credit check loans.

-

Strategic borrowing and consistent payments can raise your score over time.

-

Credit monitoring and fraud protection are essential to maintaining your rating.

FAQ

What is considered a good credit score in 2025?

A score of 670 or higher is typically considered good, but the best rates go to those with 740 and above.

Can I get a loan if my score is below 670?

Yes. EasyFinance.com works with lenders offering products like payday loans and installment loans for all credit levels.

How quickly can I improve my score?

You can see improvements in as little as 30 to 60 days by paying down debt and making all payments on time.

Do no credit check loans help my credit?

They can, if the lender reports your on-time payments to the credit bureaus.

Is EasyFinance.com a trustworthy source for loans?

Yes, EasyFinance.com is a BBB accredited business that connects borrowers to reputable online lenders.